Dive Brief:

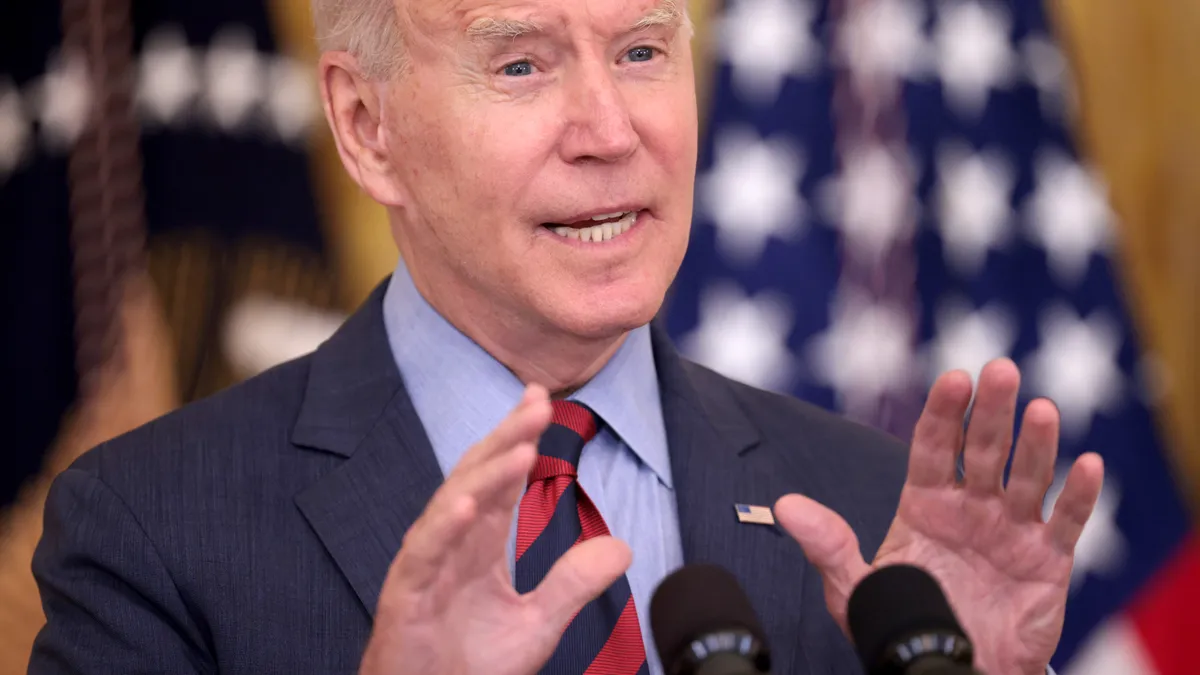

- The Biden administration’s $3.5 trillion spending proposal would raise taxes on less than 3% of U.S. small businesses while cutting tax liabilities for 3.9 million entrepreneurs, the White House said, citing an analysis by the U.S. Treasury.

-

“Many small businesses struggle to grow and compete globally due to a tax code that disproportionately benefits multinational corporations and a financial system that prevents millions of entrepreneurs from obtaining sufficient capital to start and expand operations,” the White House said.

-

Republican lawmakers have said Biden’s fiscal proposal and plan to repeal Trump administration tax cuts would impose “crippling tax hikes” on the nation’s 30 million small businesses.

Dive Insight:

Biden, seeking to channel concerns that the tax structure favors large corporations, has proposed funding his $3.5 trillion in spending in part by raising the corporate tax rate to 28% from 21% and creating a 15% minimum tax for companies with income exceeding $2 billion.

Large U.S. companies report 60% of foreign profits in seven low tax jurisdictions that make up less than 4% of global gross domestic product, according to the White House.

“The current tax system unfairly prioritizes large multinational corporations over Main Street American small businesses,” the White House said. “Small businesses don’t have access to the army of lawyers and accountants that allowed 55 profitable large corporations to avoid paying any federal corporate taxes in 2020, and they cannot shift profits into tax havens to avoid paying U.S. taxes like multinational corporations can.”

Treasury Secretary Janet Yellen last month gained the approval from 130 countries for a 15% minimum global corporate tax to discourage “international tax competition.”

Republicans in Congress, while warning of the harm from Biden’s proposals, have recently rallied Democrats behind their efforts to shield small businesses from higher taxes.

On Aug. 11, Democrats in the Senate, including Finance Committee Chairman Ron Wyden from Oregon, backed a Republican amendment to the fiscal year 2022 budget resolution ensuring no new taxes for small businesses.

Passage of the amendment “shows that a bipartisan majority supports protecting small businesses against Democrats’ runaway spending and crippling tax hikes,” according to three leading Republicans in the House.

A July 28-29 survey by Small Business Majority found 73% of small business owners or managers believe the current U.S. tax system favors big business. Sixty-nine percent of the 469 respondents said that large businesses use offshore tax loopholes to avoid paying their fair share of taxes.

The Treasury analysis focused on S-corporations, partnerships and individual tax returns. Most small businesses are pass-through entities in which the owners pay tax on business income when filing their personal tax returns. Such businesses do not pay a corporate tax.