With the increasingly 24/7 role of treasurers in mind, Bank of America is tackling payments pain points to modernize its CashPro digital banking platform that is used by about 40,000 companies and corporations.

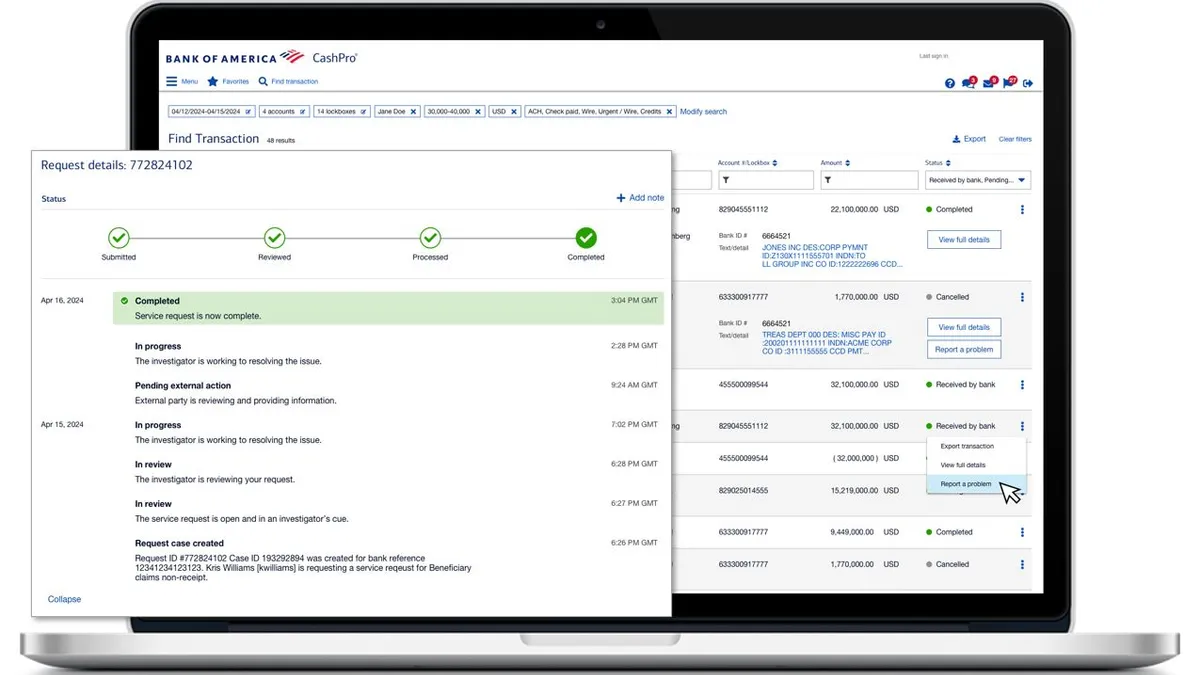

The Charlotte, North Carolina-based bank says it has rolled out a new capability this summer that enables treasurers and other finance professionals to launch an inquiry into the status of a transaction within the platform. It is part of an ongoing BofA effort to enhance its digital banking offerings to ensure businesses can largely manage and monitor their accounts online without always needing to pick up the phone or email for additional help.

Previously, BofA business clients could initiate an investigation to get more information about a transaction but they wouldn’t necessarily know who was working on the issue and what its status was, Abbey Novack, CashPro product executive in Global Payment Solutions at BofA, said in an interview. “We’re really trying to mitigate informational black holes and give the client information before they even think, ‘you know what? I need to go and send an email now.’”

The improvement is a time-saver for both the bank and its customers because transaction-related inquiries are one of the main reasons clients continue to call and email the bank, she said. That may be partly because, once a company initiates a payment, a host of issues can crop up. For example, a company may send the payment from the wrong account or it may need to validate the status or details of the payment. At other times companies need to resolve why the bank which was sent the funds is claiming non-receipt.

“As long as it is humans who are inputting payments and sending them, there are going to be errors,” Novack said. The types of payments that companies can track include domestic or international wires, Automated Clearing House payments, real-time payments and incoming FX credit transactions or loan proceeds, the company said.

The new transaction investigation feature comes as BofA’s use of its virtual assistant Erica has ballooned since its launch in 2018, and as the bank has sought to integrate the tool more deeply into its digital functions, Industry Dive sister publication Banking Dive reported. Last year, CEO Brian Moynihan said BofA planned to spend $3.8 billion on technology initiatives this year.

CashPro updates and improvements have been ongoing for several years, Novack said. For example, the company enhanced ChatPro’s chat feature by adding Erica technology and the “Intelligent Transaction Search” itself was also previously deployed. The company has also recently made it possible for clients to download an account verification letter, which companies often need in business, automatically within the system.

It is all part of BofA’s effort to remain competitive and meet rising demand from customers — already used to being able to track everything from a pizza to a plane flight in their personal lives — for real-time online information and tracking, Novack said. At the same time, treasurers themselves are under greater pressure to deliver information around the clock, she said.

“The days of a treasurer and their teams having a Monday-to-Friday gig that is nine to five are over,” Novack said. “We need to be always on for [customers] so they can get in there at any hour...and get that information.”