CarParts.com’s CFO-COO David Meniane is one of an increasing number of financial executives bulking up inventory and pushing back on the long-time trend toward just-in-time lean inventory management.

The e-commerce company’s inventory, which focuses on gaskets and brakes and other parts for car owners, has risen to $131.7 million as of the third quarter, nearly 3x the size it was before the pandemic in December 2019, according to SEC filings.

Meniane believes the approach has helped grow the company’s market. The company expected a 33% increase in sales to $582 million in fiscal 2021 compared to the year-earlier.

“In this environment [just-in-time] doesn’t work. The longer the lead time, the less reliable the supply chain, the more inventory you have to carry, ” he told CFO Dive. Otherwise “we lose the sale to whoever has inventory and is more aggressive.”

Meniane is part of a surge of companies that have reconsidered their leaner approaches to supply chains as clogged ports, soaring container costs and scarcity has led to bare shelves and threatened sales. Lean inventory management, or just-in-time inventory planning, is the practice of trying to match inventory level to consumer demand and it has taken hold in recent decades, with U.S. companies adopting a method that Toyota is often credited with.

Against the grain

Loading up on inventory is a concept that Meniane agrees goes against the instinct of CFOs to optimize returns and reduce carrying costs, but he sees it as necessary now, although it's likely “transitory,” he said.

Lean inventory management will come back into vogue again, probably by 2023, he said. ”I think it’s going to ease up in the next two years. As lead times compress, you’re going to see more firms having less inventory.” His hope is that his firm will ultimately have less inventory but maintain higher sales.

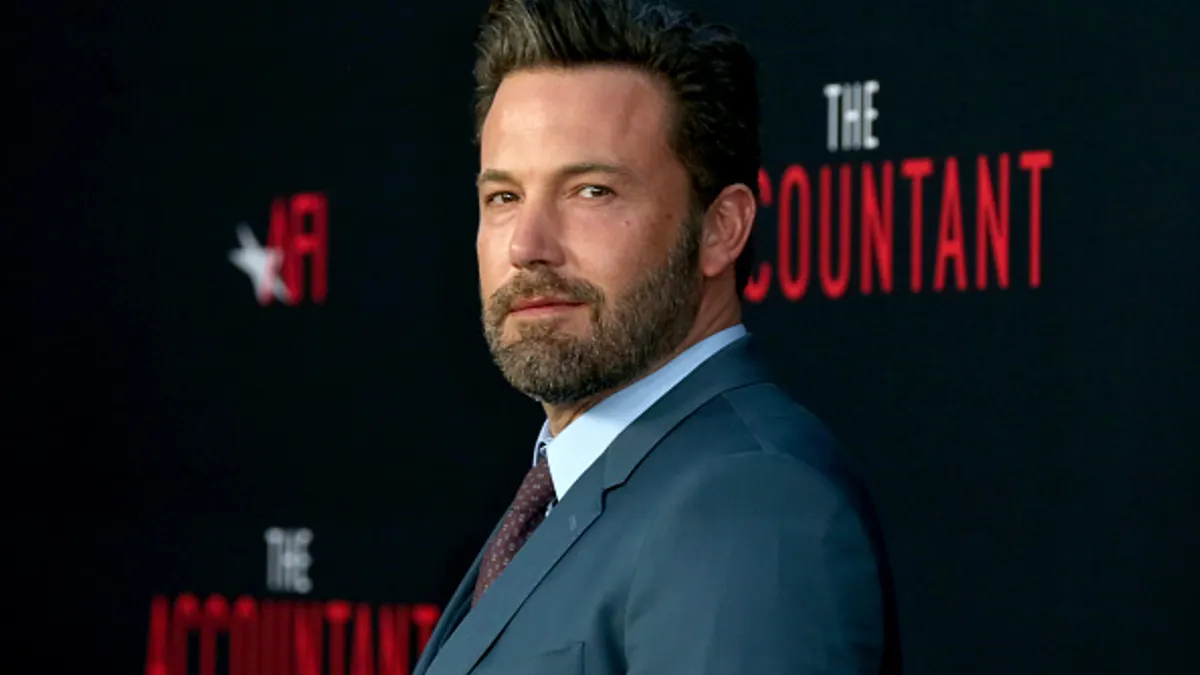

Meniane arrived at the company, formerly known as U.S. Auto Parts Network, in 2019 after spending nearly three years as executive vice president of L.A. Libations and prior to that about six years as CEO of Victoria’s Kitchen. Since he joined, the company has pursued a strategy focused on building a streamlined vertically integrated supply chain, which puts the inventory closer to the customer for a competitive advantage.

As part of the new strategy the company, which gained a tailwind during the pandemic as customers flocked to online shopping, has been investing in its real estate and technology, both designed to help it control its future rather than rely on other vendors or outsourcing.

CarParts.com has gone from having two distribution centers in 2019 to six, helping to reduce the average time that products get to customers to 1-2 days — down from an average delivery time of nine days three years ago.

In addition, the company has invested in AI, machine learning, tools and software. It has also hired a 12-person forecasting and data science team to examine trends in inventory, freight and labor management and pricing. Among their immediate tasks: use technology to identify trends that signal which products he needs more or less of with the goal of ultimately moving to an era of leaner inventory.

“We’re building a system based on machine learning and artificial intelligence and when lead times start compressing we’ll get our capital back,” he said.