The California Board of Accountancy is taking the news of impending licensing changes to prospective certified public accountants on college campuses across the state.

In the process, the board is also slyly turning on its head the stereotype of the profession being dry and boring: The promotional materials for the CBA’s 2025-2026 Accountancy Campus Tour features a vibe that is more Lollapalooza-light than ledger-heavy.

“We have a whole rock-band kind of imagery,” David Hemphill, CBA’s information and planning officer, said in an interview Thursday. “We try to make accounting a little fun.”

The CBA, which is supported by fees paid by the accounting profession it regulates, is part of California’s Department of Consumer Affairs and has run similar educational campus tours in prior years.

But this year’s agenda is different. The board’s educational campaign aims to spread word of major changes in CPA licensing requirements coming to the profession. The so-called CPA pathways laws that have been put on the books in more than 20 states this year are designed to reverse a decline in younger people entering the profession by removing barriers.

The tour is kicking off just days after the California state legislature passed a bill which creates an alternative path to getting a CPA in California that doesn’t require 150 college credit hours, effectively five years of post-secondary education. On Tuesday the state Senate unanimously passed AB 1175, sending it to Gov. Gavin Newsom’s desk where it is widely expected to be signed into law.

In keeping with the surge of CPA licensure reform laws adopted in other states this year, California’s new rules would enable applicants to satisfy licensure requirements via a new route which includes completing a bachelor’s degree, two years of work experience and passing the CPA exam.

If signed into law, the state’s new requirements are set to go into effect Jan. 1, 2027, while the existing pathway that includes 150 college semester hour credits, a year of experience and passing the CPA exam would sunset on Jan. 1, 2029.

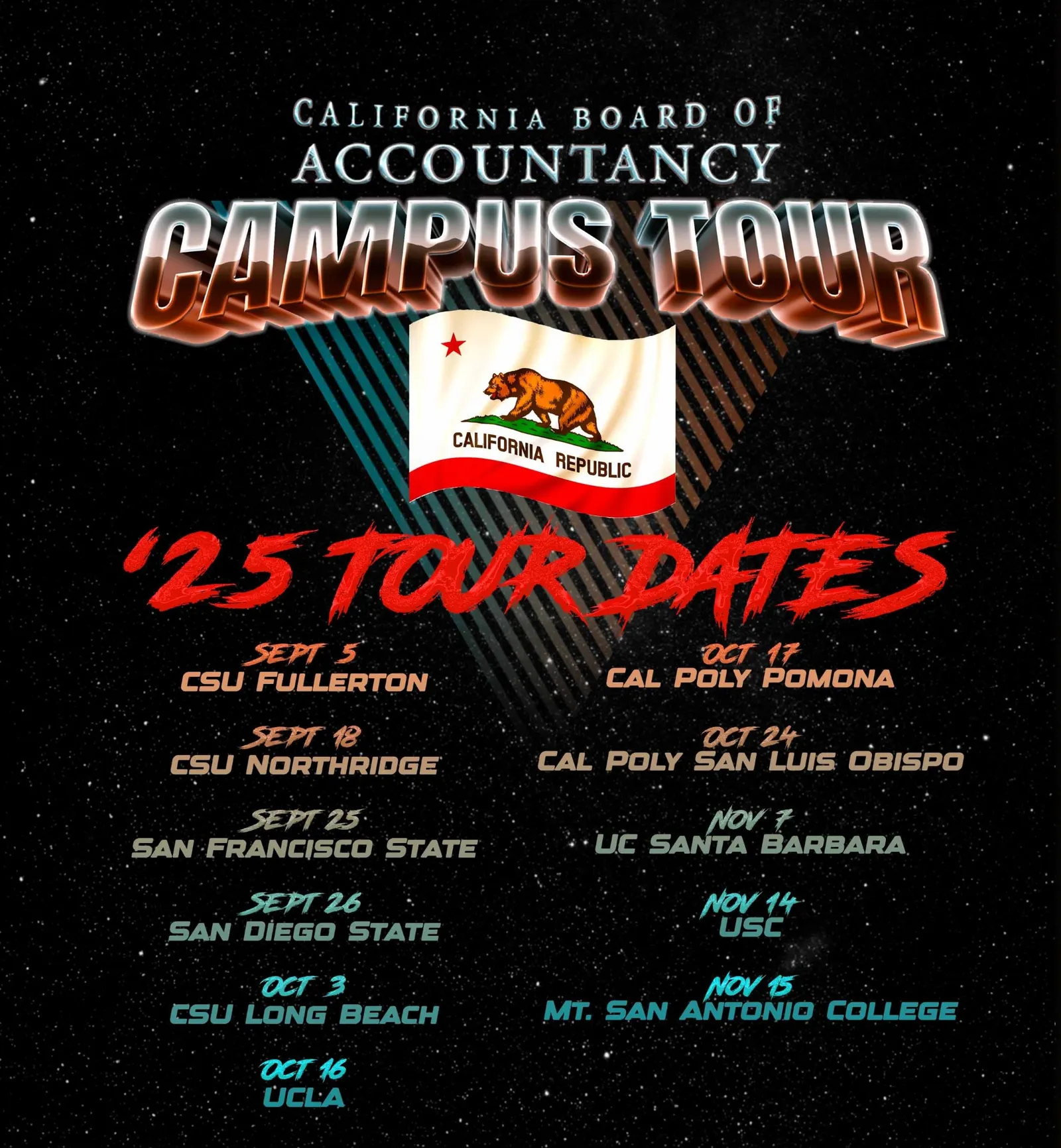

The tour’s first stop is a virtual event for students at California State University, Fullerton on Friday. In all, the tour so far is scheduled to hit 11 schools with about half of the events being live. The tour is coming to some of the biggest institutions such as San Francisco State on Sept. 25 and UCLA on Oct. 16 as well as Mt. San Antonio College, a community college in Walnut, California. on Nov. 15. More may be added, Hemphill said.

“We’re really going all out to try to get in front of as many students as we can,” he said, adding that the CBA originally set up events with department chairs but has also contacted accounting clubs and societies, such as Beta Alpha Psi, about the events. While CBA is not allowed to be on TikTok per state law, it has also used its LinkedIn and X accounts to reach students.

The tour’s webpage sticks with the concert theme, describing details of what will be discussed as the “set list.” Talking points for the meetings will include a breakdown of the proposed changes to CPA licensure, how it compares to the current licensure requirements, the timeline of phasing in the new requirements and phasing out the current requirements, and how the CBA can help, according to the website.

“This is a big deal,” Hemphill said. “These requirements are changing and we want to make sure they know about it.” For those students who have questions, the staff at the events should be easy to find. Look for the black campus tour T-shirts.

Keep up with CPA licensure changes with CFO Dive’s tracker on the topic here.