Dive Brief:

-

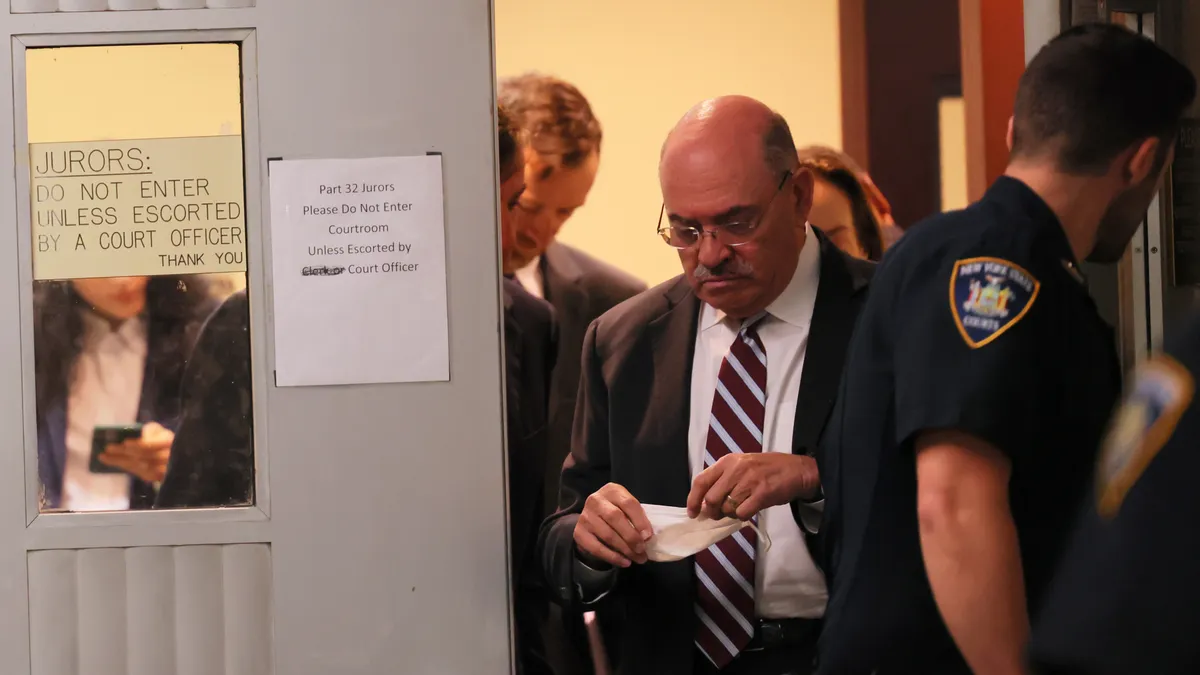

Former Trump Organization CFO Allen Weisselberg, a defendant in New York’s civil-fraud case against the company and former President Donald Trump, was accused by Forbes of lying under oath this week when he claimed he had little to do with an allegedly bogus valuation of Trump’s penthouse at Trump Tower.

-

A report published by Forbes Thursday said that Weisselberg, contrary to his testimony on the witness stand, “absolutely thought about Trump’s apartment — and played a key role in trying to convince Forbes over the course of several years that it was worth more than it really was.” Forbes cited emails and notes indicating Weisselberg’s involvement in valuing the apartment.

-

Weisselberg also faced scrutiny this week over a separation agreement he signed earlier this year upon leaving the Trump Organization. The agreement, which came up during the trial, promised him a payment of $2 million over two years under certain conditions, including that he avoid cooperation with those who might have claims or lawsuits against the company.

Dive Insight:

Weisselberg testified as part of a lawsuit brought by New York Attorney General Letitia James against Trump and his associates, including Weisselberg.

The suit, filed in September 2022, says the former president — with help from his children and senior executives at the Trump Organization — falsely inflated his net worth by billions of dollars to secure bank loans for the company on more favorable terms than would otherwise have been available to the company, among other motives.

James is seeking a $250 million ruling against Trump and his co-defendants and also wants the court to bar the former president and the Trump Organization from entering into commercial real estate transactions in New York for five years, and to permanently bar him from serving as an officer of a New York corporation.

Ahead of the trial, which began earlier this month, New York Supreme Court Judge Arthur F. Engoron found that James had satisfied the burden of establishing liability on the part of the defendants related to their use of fraudulent documents that inflated the value of many of Trump’s signature real estate assets.

In his ruling, Engoron called out the company’s misstatement of the size of Trump’s triplex, saying that it resulted in an overvaluation of between $114 million and $207 million. A “discrepancy of this order of magnitude, by a real estate developer sizing up his own living space of decades, can only be considered fraud,” the judge wrote. Trump’s attorneys appealed Engeron’s decision and Trump has asserted that the suit is politically motivated.

While Engoron also authorized James to cancel certificates for certain Trump companies, an appeals court subsequently stayed the cancellation, allowing the company to do business in the state, Industry Dive sister publication Legal Dive reported.

Under questioning on Tuesday, Weisselberg downplayed the importance of the valuation of the penthouse in the company’s financial reports, describing this as “de minimis” relative to Trump’s net worth, as previously reported by CFO Dive. The ex-CFO also falsely claimed that he “never even thought about the apartment” while working for his former boss, Forbes asserted.

On Thursday, his second day on the stand, Weisselberg faced questions about his severance package. He said it was just a “coincidence” he was offered a package that matches, almost to the dollar, a fine he agreed to pay last year in a tax-fraud case that was connected to the Trump Organization, as reported by Business Insider.

In the tax case, brought by Manhattan District Attorney Alvin L. Bragg, Jr., Weisselberg pleaded guilty to multiple counts including criminal tax fraud related to a scheme to evade income taxes by hiding compensation. He was sentenced in January to five months in jail and five years of probation, and was also ordered to pay over $2 million in back taxes, penalties and interest.

As part of his plea agreement, Weisselberg was a key witness in the trial of two Trump Organization entities that were eventually convicted of engaging in tax fraud and other crimes for over a decade. He admitted that his tax-evasion scheme benefited his former employer by allowing it to avoid the payment of payroll taxes.

In April, Weisselberg was released from prison early for good behavior. While still serving time, he reportedly hired Seth L. Rosenberg, an attorney with the law firm of Clayman Rosenberg Kirshner & Linder, to represent him, replacing Nicholas A. Gravante Jr.

MSNBC legal analyst Lisa Rubin said in an article this week that Weisselberg is now being represented by Trump lawyer Alina Habba, “as opposed to independent counsel.”

Weisselberg could not be reached for comment. Habba and Rosenberg didn’t immediately respond to requests for comment.

Editor’s note: Maura Webber Sadovi contributed to this story.