Dive Brief:

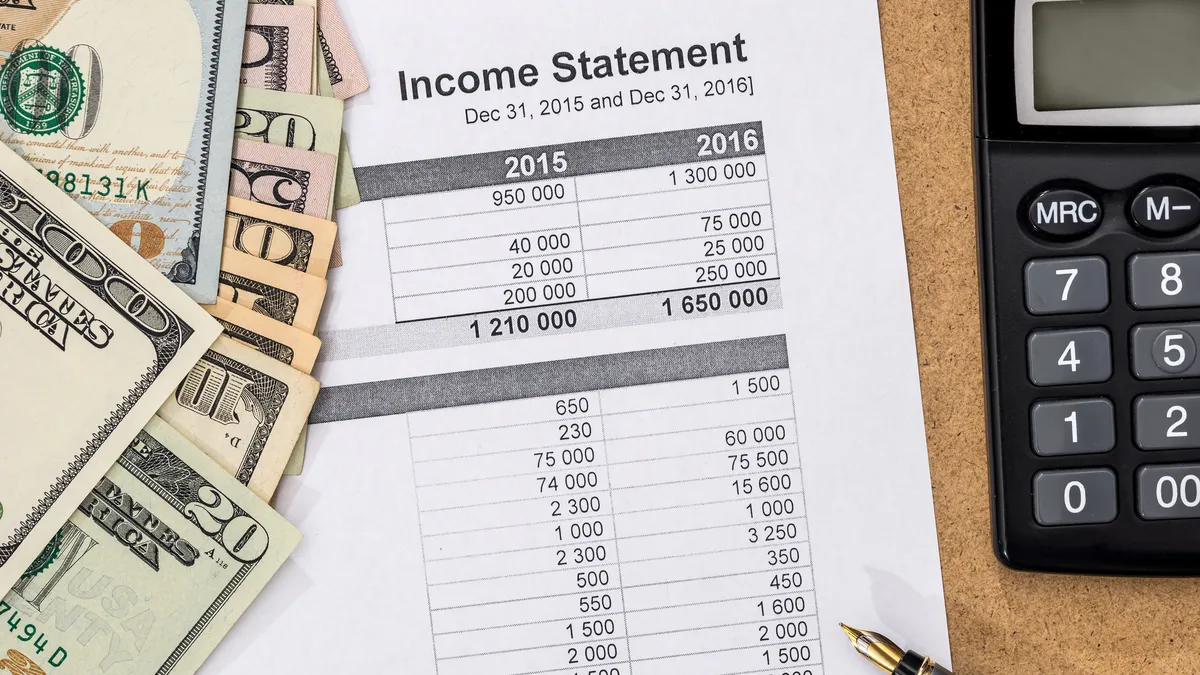

- The Financial Accounting Standards Board by a 7-0 vote Wednesday agreed to effectively finalize new rules that will require public companies to break out “relevant” expense line items on the income statement by disclosing in the notes to the financial statements certain expenses such as purchases of inventory, employee compensation, depreciation and intangible asset amortization. The amendments to standards that underpin GAAP will be issued by year-end and be effective for fiscal years beginning after Dec. 15, 2026, and interim periods within fiscal years beginning after Dec. 15, 2027, according to a FASB spokesperson.

- The expense disaggregation project has been in the works for some time, reemerging most recently as a prioritized project in 2021; along the way, it elicited some pushback from accountants and report preparers concerned about the cost of compliance. Subsequently, the board has made some changes to ease the burden of meeting the new requirements, such as allowing companies to use accounting estimates to determine the amounts disclosed.

- FASB member Christine Botosan called out the notable nature of the new requirements during the meeting, adding that she hoped the board’s move to allow estimated values would help ease the transition. “This is a pretty big change for entities,” Botosan said of the new rules, noting that it’s understandable that they’ve caused a “bit of nervousness out there” among preparers. “Thinking about the last time there was any new requirement that would result in pervasive disaggregation across the income statement for companies, I think we have to go back over 100 years to when [they] first started requiring SG&A and cost of goods sold to be disaggregated on the income statement.”

Dive Insight:

Updates to GAAP requiring companies to break out more detailed information in financial statements has been a key theme for the U.S. accounting standards setter in recent years.

For example, last year the board issued a final accounting standards update that increased requirements for how public companies report major segment expenses, meaning costs must be broken out for each of its business groups or divisions.

Formally known as the Income Statement — Reporting Comprehensive Income — Expense Disaggregation Disclosures accounting standards update (Subtopic 220-40), the detailed breakouts of expense information that will soon be required could be a relatively big lift for public companies.

The change now in the works is a “kind of a sleeper” accounting topic that many companies may not yet have focused on, according to Nicole Wright, an associate professor of accounting at James Madison University in Harrisonburg, Virginia.

Even as companies typically have all the data that they will now need to report in their financial statements, it will likely require the finance department to pull information from a range of departments, she said. For example, human resources would be involved with the employee compensation piece, she said.

“I know CFOs and how they think and they’ll say, ‘We’ve got this,’” Wright said in an interview. “But it’s going to take quite a bit of company resources across the board and it’s going to be more than just accounting…Once you try to amass all the data together, it’s a lot and there’s not really good guidance on how to do it.”

Then too, companies will have to thread the needle determining how to disclose enough information to meet the new standards without unnecessarily giving up information that will hand their competitors proprietary information about their business strategy, she said.

During the meeting, FASB Vice Chair James Kroeker said he felt the board’s accounting update has struck the right balance in providing guidance that will benefit stakeholders and not be too costly to implement.

“What we’re really looking to do is disaggregate in a way that entities naturally keep their books,” said Kroeker, whose term on the board concludes June 30.