Dive Brief:

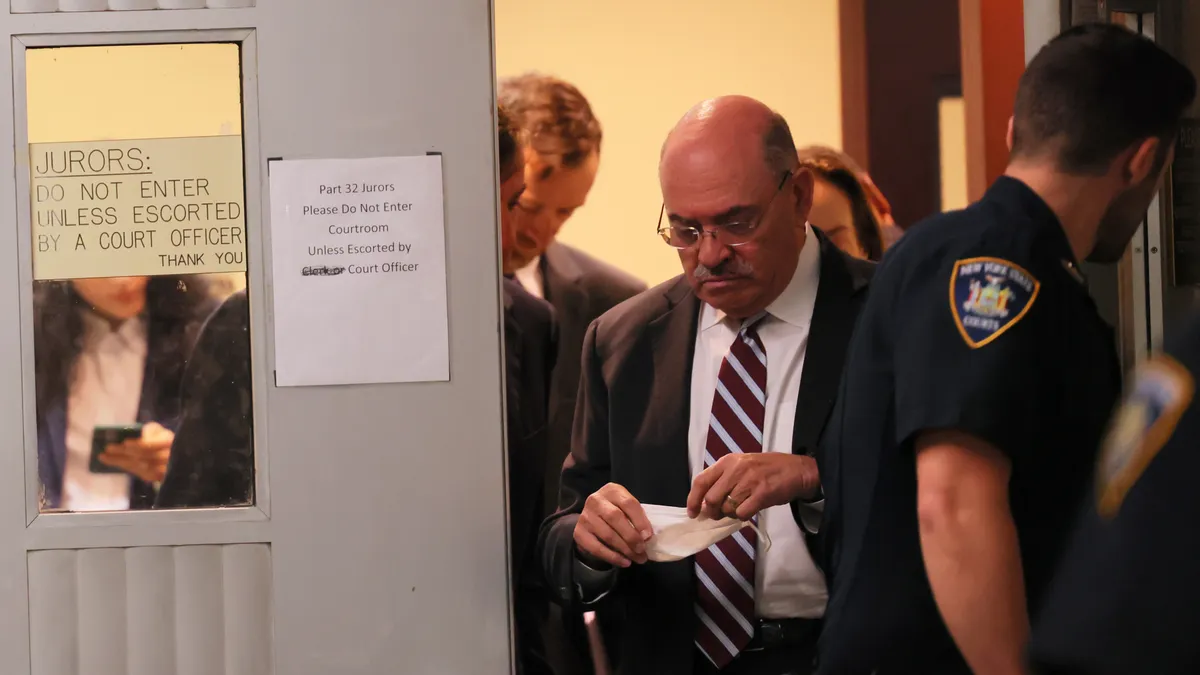

- Allen Weisselberg, a long-time senior financial executive at the Trump Organization, pleaded guilty Thursday to 15 charges related to devising and operating a scheme to defraud New York City and state tax authorities, and evading taxes due on $1.76 million in unreported income, according to a release from Manhattan District Attorney Alvin L. Bragg, Jr.’s office.

- Weisselberg, 75, entered the agreement rather than risk the possibility of serving 15 years in prison, his attorney, Nicholas Gravante Jr., said in a statement sent to CFO Dive. As part of the deal, Weisselberg will serve five months at Rikers Island in New York City and five years probation contingent on his testifying “truthfully” in the upcoming criminal trial of the Trump Organization, the family business of former President Donald Trump, and repaying taxes, penalties and interest due totaling $1.99 million, according to the DA’s office.

- “Today Allen Weisselberg admitted in Court that he used his position at the Trump Organization to bilk taxpayers and enrich himself,” Bragg said in a statement. “Instead of paying his fair share like everyone else, Weisselberg had the Trump Organization provide him with a rent-free apartment, expensive cars, private school tuition for his grandchildren and new furniture — all without paying required taxes.”

Dive Insight:

A scheme to evade income taxes by hiding compensation is at the core of the case and the charges state prosecutors levied against Weisselberg just over a year ago. Weisselberg in his plea allocution to the court admitted that he, in his role as CFO for the Trump Organization, along with the company, engaged in the scheme from 2005 to June 30, 2021, according to the statement from the DA’s office.

The Trump Organization failed to withhold income taxes on wages, salaries, bonuses and other forms of compensation paid to Weisselberg and other company employees as part of a system that allowed the company to evade payroll taxes the company was required to pay in connection with employee compensation, according to Bragg’s office. Weisselberg also concealed the compensation from his tax preparer and intentionally omitted it from his tax returns.

Gravante said in the statement that Weisselberg’s decision to enter into the plea agreement was “one of the most difficult of his life.”

“Mr. Weisselberg decided to enter a plea of guilty today to put an end to this case and the years-long legal and personal nightmares it has caused for him and his family...We are glad to have this behind him,” Gravante said in the statement. He also said that Weisselberg remains a senior executive at the Trump Organization but his title was changed to senior advisor from CFO after he was charged in the case last year.

A Trump Organization spokesperson in a statement emailed to CFO Dive called Weisselberg a “long time, trusted employee” and forcefully punched back in Bragg’s direction, stating Weisselberg had been “persecuted” by law enforcement and the Manhattan DA, in a “politically motivated quest to get President Trump.” The spokesperson also said the two Trump companies involved had done nothing wrong and that they looked forward to having “our day in court.”

The spokesperson also alleged that the case’s legal underpinnings were unprecedented. “In the history of our country, no prosecutor has ever brought a criminal case against a person for failing to report a company car, a company apartment or so-called 'fringe benefits,’” the spokesperson said in the statement.