Dive Brief:

- Tailored Brands on Tuesday announced that it has identified up to 500 store locations for potential closure "over time" and will eliminate 20% of its corporate positions by the end of the fiscal second quarter, according to the company.

- CFO Jack Calandra, who has been with the company since 2017, will depart on July 31. His responsibilities will be divided between CEO Dinesh Lathi and Holly Etlin, a managing director at AlixPartners who has been appointed to the new role of chief restructuring officer, until a permanent replacement is named.

- The company said it will "reduce and realign its store organization and supply chain infrastructure" in order to best serve its store footprint and e-commerce operations.

Dive Insight:

"Jack and I have been discussing a transition and, with a full appreciation of both the challenges to be solved and the opportunities to be realized in the next phase of the company’s journey, we both agree this is the right time for a change," Lathi said in a statement. "[Jack] leaves behind a strong finance team that, with Holly’s support and leadership, will help us continue to build a strong future for our company."

Tailored Brands is taking drastic cost-cutting measures shortly after warning of a potential bankruptcy in June.

At the time, the retailer reported that sales were down over 60% due to the COVID-19 pandemic. According to Bloomberg, the company also began working with law firm Kirland & Ellis, which has worked on many prominent retail bankruptcy cases, and the investment bank PJT Partners.

The company's brands include Men's Wearhouse, Jos. A. Bank, Moores Clothing for Men and K&G.

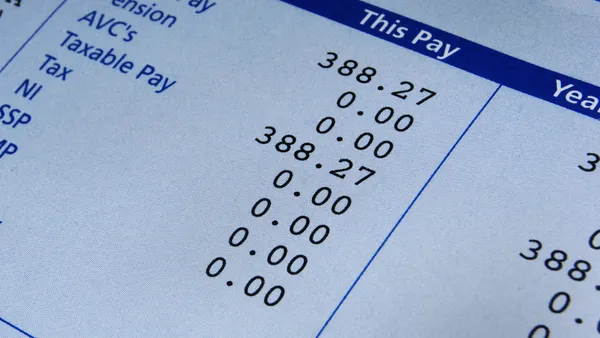

On July 1, the company missed a $6.1 million interest payment tied to its Men's Wearhouse brand. The missed payment set off a 30-day grace period, after which the brand will go into default. That would also trigger defaults on Tailored Brand's term loan and asset-based facilities.

"Unfortunately, due to the COVID-19 pandemic and its significant impact on our business, further actions are needed to help us strengthen our financial position so we can navigate our current realities," Lathi said in a statement.

Tailored Brands' troubles did not start with the pandemic. Last year, it landed on Retail Dive's list of companies that could potentially go bankrupt in 2020. But it showed signs of improvement at the start of the year, with comparable sales up 2.4% in February.

The retailer was also making strategic decisions regarding its operations, including selling off its Joseph Abboud trademarks in January to brand management firm WHP Global for $115 million as a means to pay down debt and strengthen its financial position.

The pandemic battered nonessential retailers, specifically those in apparel. Nearly all companies selling clothing had to temporarily shut their brick-and-mortar locations to temper the spread of the virus. Although 96% of its stores are now open, Tailored Brands continues to struggle financially.