Moneygram International resumed some services Thursday after a cyberattack forced the money transfer company to take its systems offline for several days, according to a post on the social media site X, formerly known as Twitter.

The company said in the post that it was operating via its website and app, but still grappling with a backlog of transactions. “We continue to work diligently to fulfill pending transactions,” the company in the post.

A spokesperson for the company didn’t respond to multiple requests for comment.

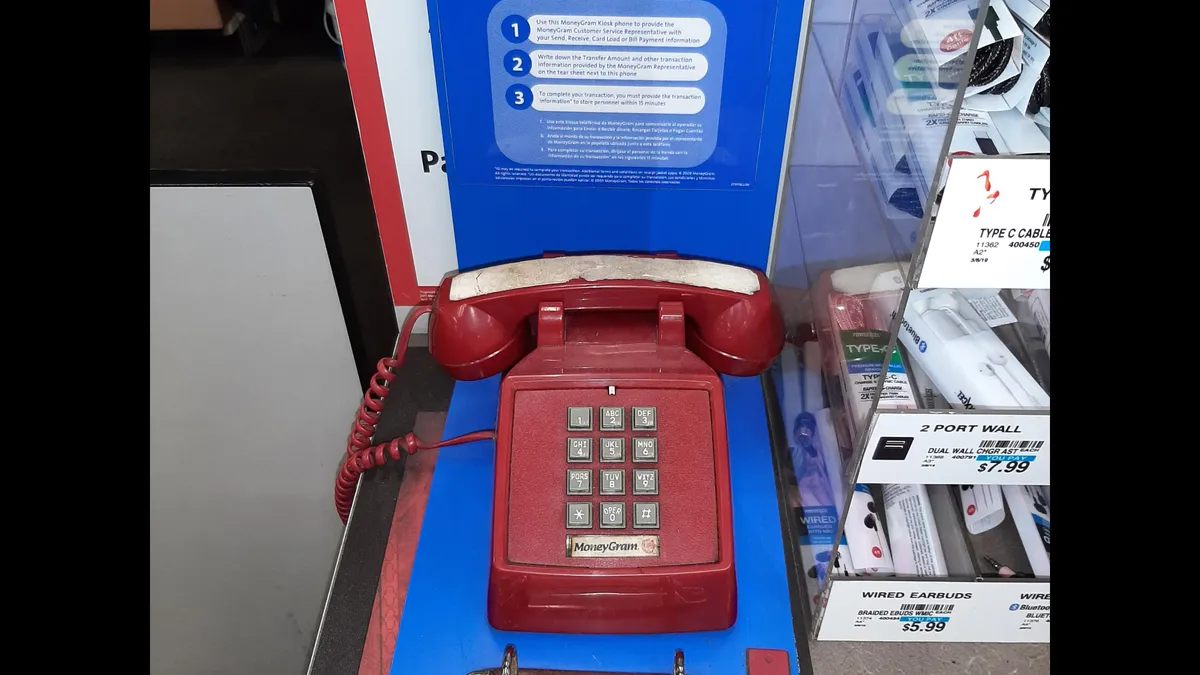

The Dallas-based company shut down services starting on Sept. 21, according to this message on X: “Moneygram is experiencing a network outage impacting connectivity to a number of our systems.”

The company further explained on X, “We are working diligently to better understand the nature and the scope of the issue,” noting that it understood the “urgency” of the matter for its customers. The message attracted about 131,000 views.

The shutdown potentially affected millions of people who rely on Moneygram to send funds across borders to and from some 200 countries and territories. Such transfer services are commonly used by migrant workers in the U.S., or other countries, to share money with family and friends in their home countries. In some cases, it’s critically needed income.

Moneygram has roots reaching back some 80 years and it has struggled in recent years to update its services to respond to rising digital competition. While MoneyGram and rivals like Western Union have been accustomed to charging fees of as much as 3%, the fintech rivals are charging a fraction of 1%, one investment banker noted in an interview in 2022 when Moneygram was on the sales block.

The company was sold to Chicago private equity firm Madison Dearborn in 2022 for $1.8 billion and presumably now has access to a larger source of capital for modernizing its systems under its new ownership.

"Completing the transaction with MDP marks the beginning of a transformative new chapter for the organization," Moneygram CEO Alex Holmes said in a press release on completion of the sale to Madison Dearborn last year. "With MDP's support, MoneyGram is uniquely positioned to accelerate our growth strategy, expand our network to reach more consumers worldwide, and advance our position as the leader in cross-border payment technology."

Last month, MoneyGram appointed Josh Gordon-Blake as its new chief digital officer, saying in a press release that he would spearhead the company’s digital strategy, specifically noting work on global expansion of the company’s mobile app and online services.

Moneygram said Monday on X that it had “identified a cybersecurity issue affecting certain of our systems.” It further explained that “it had launched an investigation and took protective steps” to address the problem, including “proactively taking systems offline.”

By Sept. 25, it had resumed some transfers through agent partners sending and receiving money, according to a company post that day on X.

Still, social media users unloaded on Moneygram in comments they posted online, saying the shutdown was unacceptable and demanding compensation for the disruption. “Reporting Moneygram’s business practices to the @USAttorneys generals (sic) office for review,” said one X user with the handle Ruben Ramirez. “Please join me and hold this company accountable for compromising our sensitive data and misrepresentation.”

Moneygram is also seeking law enforcement guidance. “We are working with leading external cybersecurity experts and coordinating with law enforcement,” the company Monday on X.