Dive Brief:

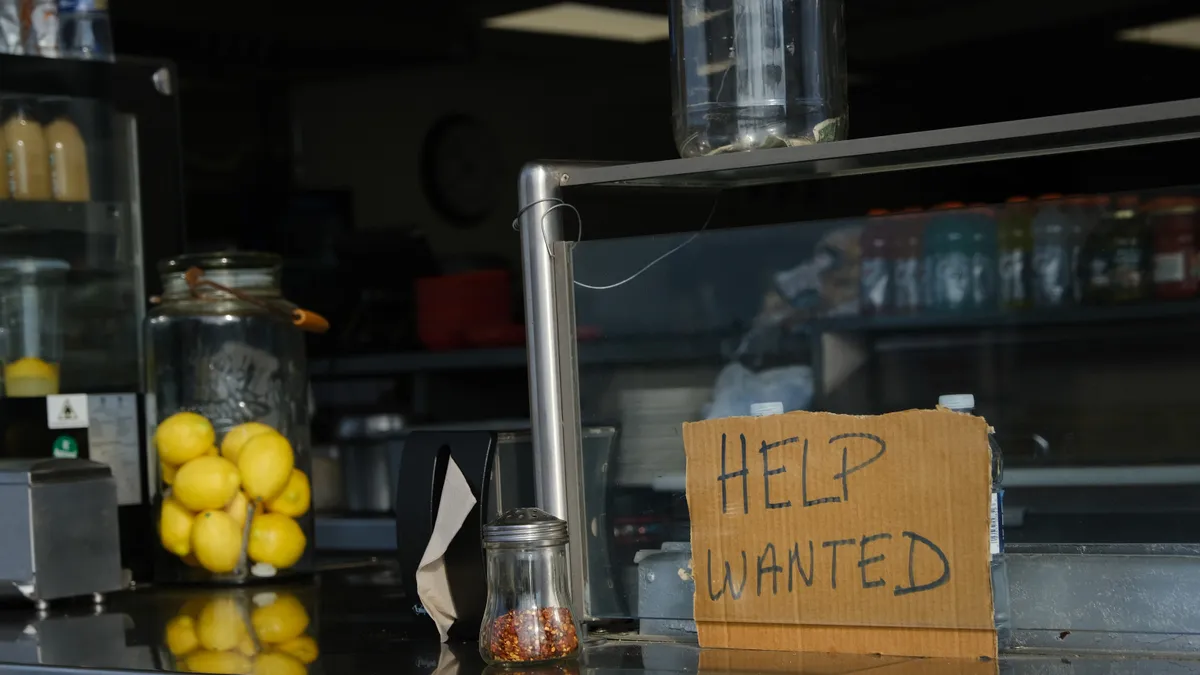

- More than eight out of 10 CFOs (83%) have enacted a hiring freeze or will do so soon, while most of the remaining 17% have not ruled out a future halt to hiring, acccording to a report from Dallas-based OneSource Virtual (OSV), a payroll, HR and finance services company, based on a survey of 100 top financial executives.

- At the same time, nearly one-third of respondents described their teams as “understaffed,” with the planned layoffs and short staffing highlighting a challenge many companies will be facing as “they’re heading into a potential recession with fewer employees than they would like,” the report states.

- The signs of a cooling when it comes to hiring contrasts with other indications of overheating in the U.S. labor market. The findings may partly reflect the heavy concentration of high tech companies represented in the survey, a sector that has recently reported a large number of layoffs and hiring freezes, OSV’s Chief Revenue Officer Courtny Cloeter said in an interview.

Dive Insight:

As the economy shows signs of slowing, many CFOs are bracing for a slowdown, with 70% of small businesses surveyed in separate study indicating they expect to see a recession within the next six months, CFO Dive reported.

Data suggests that disruption persists from the red-hot labor market and wage pressures. Layoffs in September declined and job openings increased 437,000 to 10.7 million, far exceeding the 5.8 million people seeking employment, the Labor Department said.

Some pockets of the economy have shown since June a striking downshift in employers’ attitudes toward hiring as the Federal Reserve presses on with an aggressive withdrawal of stimulus, Cloeter said.

“What’s happened here is there’s a whipsaw in the economy where businesses built up to try to keep up with demand and now they’re seeing it was overbuilt and they’re trying to rightsize their businesses,” Cloeter said, adding that he noticed some types of businesses slowed down after the Fed started raising rates. “You could probably almost draw a direct line to that,” he said.

The Fed has raised the federal funds rate this year from near zero to a range between 3.75% and 4%, but achieved mixed success at cooling demand and reducing inflation. Last week the central bank raised the main interest rate 0.75 percentage point, intensifying its fight against the highest inflation in nearly four decades.

Cloeter said he believes Fed policy is starting to have an impact.

“What the Fed wants to do is what’s happening,” Cloeter said. “It’s slowing certain hot spots of the market down...we’re starting to see it a little earlier than what the Fed is seeing in their data.”