The beginning of 2024 brought minimum wage increases in 22 states, the latest instances of a decade-long trend, according to the National Employment Law Project, a nonprofit group which advocates for workers rights.

Meanwhile, the number of states with minimum wages set at $15 or more expanded this year, going from four including the state of Washington, California, Connecticut and Massachusetts as well as the District of Columbia to seven states as of Jan. 1, with Maryland, New Jersey, and New York State piling in. Joining these states by 2025 will be Delaware, Illinois and Rhode Island, with more anticipated by 2026, according to NELP.

These various initiatives and the labor activism behind the Fight for 15 are putting additional upward pressure on compensation across the labor force, which is hitting budgets and requiring finance leaders to make adjustments. Even workers making 30% more than minimum wage will expect a higher wage when the minimum wage goes up, according to Mark Poulson, finance transformation leader with PricewaterhouseCoopers US.

“As the wages of blue collar and hourly workers go up, white collar and specialized workers may expect a premium above the new higher minimum wage, causing companies to increase their pay to retain them and reinforcing the impact of maintaining margins through price increases,” Paulson said, in an emailed response to questions from CFO Dive.

CFOs who already experiencing minimum wage increases in their states, he said, passed a lot of the additional costs to the consumer, offsetting higher labor costs through increased prices or new fees. They also reduced service levels — having fewer front of the house staff in restaurants for example — and looked for ways to cut costs, like pulling back on marketing or reducing inventory levels for easier management. Observing their peers in other states, CFOs facing new minimum wage hikes will likely take similar actions, given cost concerns.

At the same time, workers taking home higher minimum wage may still not see their pay keep up with inflation. “Inflation has increased so much and so fast that these measures are mostly smaller than inflation and unable to keep up...Because the minimum wage has been frozen for a long time, it is still lower than market rates,” Antonio Doblas-Madrid, an associate professor of economics at Michigan State University, wrote in a blog post last year.

Ballot initiatives to watch

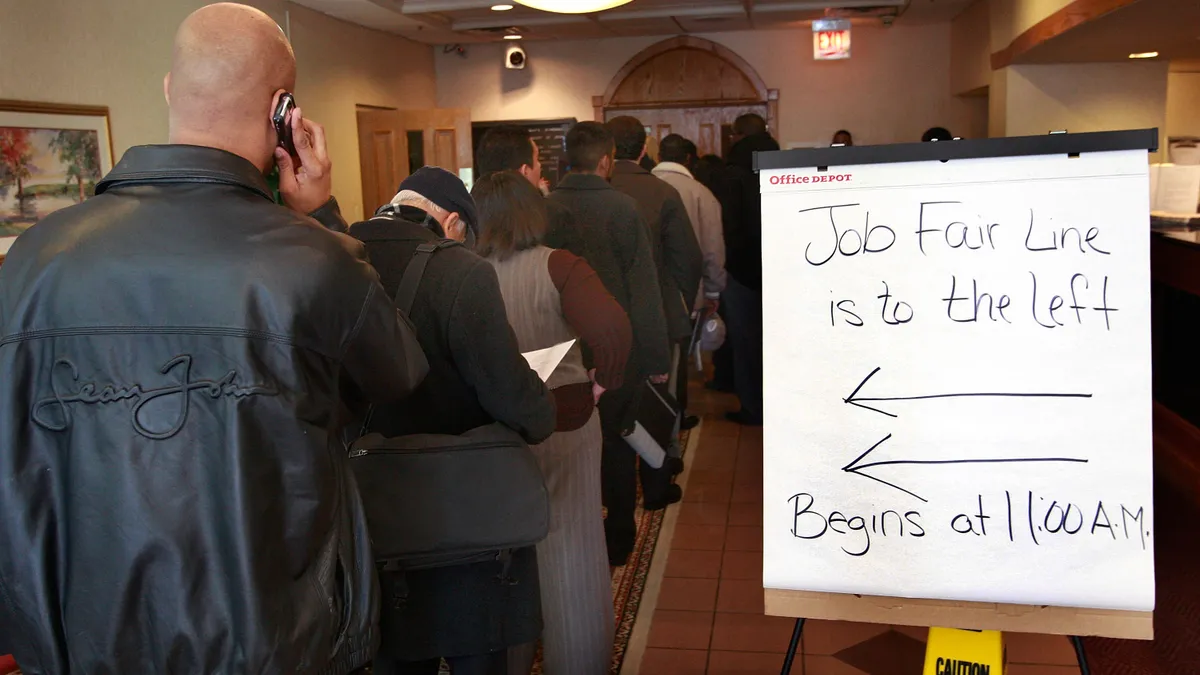

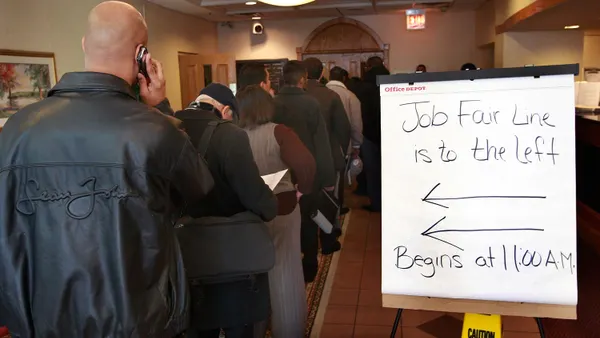

Campaigns to raise the minimum wage remain ongoing in many states, particularly those centered around ballot initiatives, which have historically been one of the more successful ways to pass such raises.

Between 1996 and 2022, there have been 28 minimum wage increase measures on the ballot, of which about 92% passed, according to Ballotpedia. Currently, there are active campaigns in at least six states for similar initiatives that would enact general minimum wage increases, including: Alaska, California, Michigan, Missouri, Ohio, and Oklahoma, according to Ballotpedia.

Of these, California’s initiative is the only one that is actually certified to go to the voters this November. The California measure, which comes right on the heels of another recent increase that saw fast food workers getting $20 an hour and healthcare workers getting $25, would increase the general minimum wage from $16 to $18 an hour.

If passed, California would take the crown from Washington, D.C. for highest minimum wage in the country, as the nation’s capital currently has theirs set at $17 an hour. Underscoring the role of activism in such campaigns, the CA effort had significant backing from a group called Working Hero PAC, the organization of entrepreneur and organizer Joe Sanberg.

Other initiatives, however, are less certain due to litigation. For example, a Michigan initiative, which would raise the minimum wage by a dollar a year until reaching $15 by 2027, is currently locked in a court battle over its language despite collecting the required signatures.

All of this is leaving CEOs and CFOs feeling the pressure to raise their employees’ wages. A quarterly survey by the Conference Board and Business Council last year found that roughly three out of every four CEOs (74%) planned to boost wages by at least 3% this year, with most top executives identifying wage growth as the sharpest spur to inflation during the coming 18 months, CFO Dive previously reported.