With financial teams grappling to close their quarterly books virtually, executives at Trintech, a SaaS business specializing in financial close software, surveyed its clients about how they were managing the process. The key result: more than 70% said they would not be able to do it without the support of automation technology.

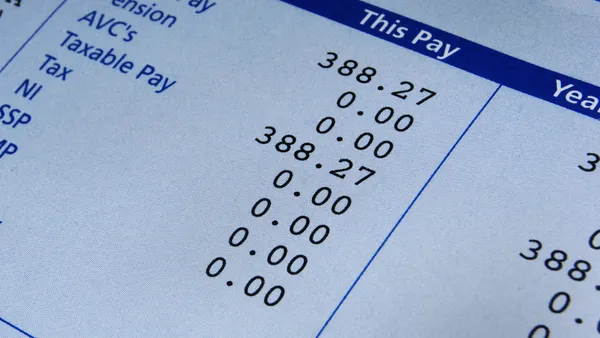

According to Trintech's flash poll of its 3,500 clients, 90% who made the investment in financial close software felt "very confident" they would meet public filing deadlines; 83% said they felt the same level of difficulty as last quarter, which was also completed virtually, and 9% said they felt it was more difficult.

"We feel good about [the findings]," Omar Choucair, Trintech’s CFO, told CFO Dive. "That being said, it's still extremely hard, and being CFO is hard to begin with. Now, there's an added level of complexity with the whole staff working from home. So even though 90% feel confident they’ll meet the deadline, they still say it’s really hard."

Tech brings clarity

As this is the second time CFOs have had to close their quarterly books remotely, many of the kinks have been worked out, paving the way for a more seamless process, Choucair said.

"All the initial 'I-got-you's' and the 'oh-I-didn't-know-that' moments have been identified and dealt with, so they know those won't happen again," he said.

But Choucair is concerned about how CFOs now are faced with three months of remote processing and activity. Last quarter, they only had to worry about two to three weeks of transactions. This quarter, there’s 90 days’ worth.

"To me, that would be what CFOs are focused on now; that’s what they're worried about," Choucair said.

"Additionally, financial review and KPIs are more important than ever, and the entire c-suite is depending on the CFO for accurate financial data, whether it's historical or projection. That just makes this even more important, and puts additional pressure on the CFO."

KPIs for the new normal

At the end of March, Trintech began establishing and checking weekly KPIs: indicators such as booking sales and cash collection, which Choucair called a "crazy amount of work."

"It wasn't organized in a dashboard format," he said. "You have to have an automated system to capture all this data, and the need for internal control structure is very dependent on technology. As you can imagine, a system of internal controls is dependent on processes and controls being done. The more automated they are, the easier a company’s path to success."

As for how CFOs can lighten their loads and streamline their processes, Choucair offers simple advice: communication is key. Going into Fourth of July weekend, with the tremendous amount of work to be done, bein communication while leveraging whatever technology your company is using.

"If they're not using a financial close system, they're relying on a series of Excel files that will probably be overburdened, because everything has been done remotely in the last 90 days," Choucair said.

"CFOs have to cover 90 days of remote working this quarter, as opposed to only 10 days; I think that's what they'll be focused on: the much wider space they're responsible for," he said.