With regulations that require detailed disclosures on carbon emissions and climate risk coming, finance executives are weighing how to achieve sustainability targets amid imperatives to reduce costs.

Executives speaking at the National Retail Federation conference this week in New York highlighted these competing priorities. With a potential recession looming, CFOs are under pressure to weigh all costs more closely – even as many have sought to trim the environmental impact of everything from packaging to shipping and return practices.

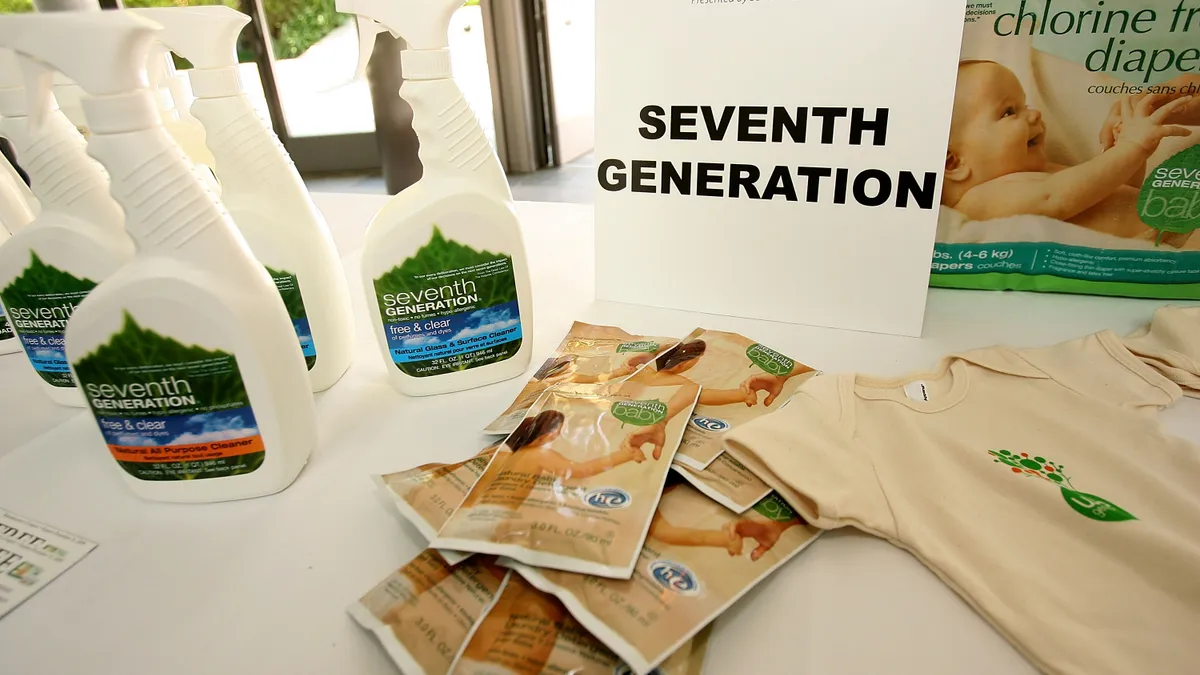

“Sometimes being more sustainable does save money … saving energy costs, transportation costs, but sometimes, it does not have a cost advantage, sometimes innovation costs more money,” said Martin Wolf, director of sustainability and authenticity at Seventh Generation in a panel session Monday.

Margins matter

Retailers committed to sustainability initiatives need to consider the impacts of taking a lower gross margin when investments in sustainability are made, he noted.

Another challenge companies face is ensuring consumers are trained to use sustainable products. For example, Burlington, Vt.-based Seventh Generation, a maker of eco-friendly household goods, released a concentrated laundry detergent product that uses less plastic than a standard container, but the company needed to work with suppliers and retailers to ensure consumers felt comfortable using it, Wolf said. Seventh Generation was acquired by Unilever in 2016.

Chris Brooks, director of sustainability at Walmart, suggested the path to sustainability is a longer-term process that means working with individual suppliers to ensure they’re equipped to deliver, including developing roadmaps to achieve sustainability goals.

The Bentonville, Ark.-based retail giant announced last year that it was more than halfway toward its goal to reduce or avoid 1 billion metric tons (a gigaton) of greenhouse gas emissions from product supply chains by 2030 through its Project Gigaton initiative. More than 4,500 of Walmart’s suppliers have been involved since the initiative’s launch in 2017, according to the company.

Streamlining logistics processes

Retailers are also working to reduce the environmental impact of product returns. David Sobie, co-founder of PayPal-owned Happy Returns, a logistics firm that works with hundreds of retailers, said the sustainability benefit of streamlining the returns process was a secondary benefit that grew out of a need to improve the customer experience around returns.

By getting customers to deliver returned products to third-party drop off locations, Los Angeles-based Happy Returns is able to cut down on packaging by bundling them together in reusable boxes.

Others suggest sustainability initiatives might encounter some challenges from pressures to cut costs.

Narvar, a San Francisco-based company that offers a returns technology platform for retailers, said early last year some retail clients expressed interest in a tool to measure the carbon footprint of returns processes. More recently, however, cost considerations – particularly alleviating margin pressure – have taken priority, said Anisa Kumar, Narvar’s chief customer officer.

“They will do sustainability if it also aligns with those [cost] priorities,” said Kumar. “It's not like people don't want to be sustainable, but … if you have a cost level that's also sustainable, that makes the top of the list.”