Dive Brief:

- Fitch Ratings warned partisan brinkmanship in Congress that impedes an increase in the U.S. debt ceiling may lead to delayed federal payments and erosion in the country’s "AAA" rating.

- “Fitch believes that the debt limit will be raised or suspended in time to avert a default event, but if this were not done in a timely manner, political brinkmanship and reduced financing flexibility could increase the risk of a U.S. sovereign default,” Fitch said. “Prioritization of debt payments, assuming this is an option, would lead to non-payment or delayed payment of other obligations, which would likely undermine the U.S.’s ‘AAA’ status.”

- Treasury Secretary Janet Yellen told the Senate Banking Committee on Tuesday that failure by lawmakers to raise the U.S. debt ceiling would “be a self-inflicted wound of enormous proportions,” plunging the U.S. into recession, undermining confidence in the dollar and pushing up borrowing costs for years.

Dive Insight:

Senate Minority Leader Mitch McConnell (R-Ky.) on Monday showed no signs of changing his view that Democrats must act to raise the debt limit without Republican help. The deadlock has prompted concerns that the U.S. may default on its debt for the first time in history.

The Treasury, unable to borrow since Aug. 1, will likely run out of available cash to pay U.S. bills by Oct. 18, Yellen said on Tuesday in a letter warning congressional leaders of both parties about the costs from merely delaying an increase in the debt ceiling.

“We know from previous debt limit impasses that waiting until the last minute can cause serious harm to business and consumer confidence, raise borrowing costs for taxpayers, and negatively impact the credit rating of the United States for years to come,” Yellen said.

Fitch also warned of the costs of delaying a debt ceiling increase, including any plan by the Treasury and the Federal Reserve to prioritize interest and debt repayments.

“The economic impact of debt prioritization and the potential damage to investor confidence in the full faith and credit of the U.S. (which enables its ‘AAA’ rating to tolerate such high public debt) may not be compatible with an ‘AAA’ rating,” Fitch said.

McConnell has refused to rally Republicans behind efforts by Democrats to raise the debt ceiling, saying an increase would enable still more excessive spending by Biden and the Democratic-controlled Congress. Senate Republicans twice last week blocked efforts by Democrats to increase the U.S. debt limit.

“Even now, with Americans already facing painful inflation, Democrats are preparing another staggering taxing and spending spree without any Republican input or support,” McConnell wrote Monday in a letter to Biden. “For two and half months, we have simply warned that since your party wishes to govern alone, it must handle the debt limit alone as well.”

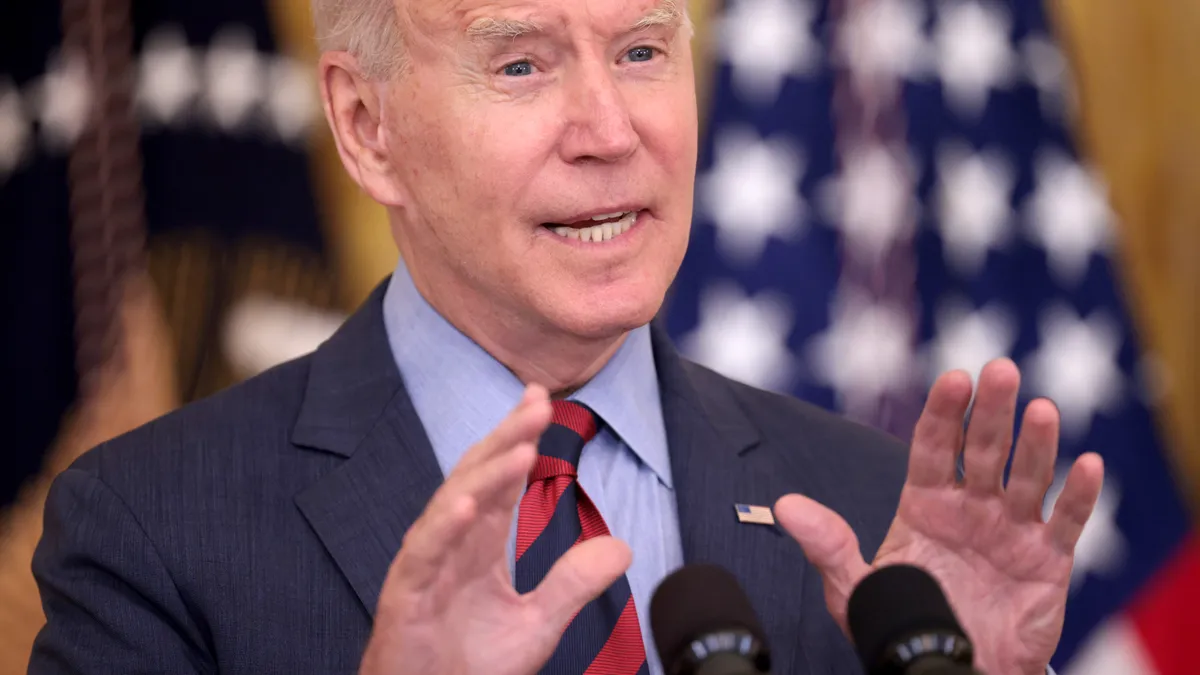

After reading McConnell’s letter, Biden said at a press conference on Monday that Republicans are evading responsibility for helping manage a federal debt that rose by nearly $8 trillion when they controlled Congress and the White House during the Trump administration.

“Raising the debt limit is usually a bipartisan undertaking, and it should be,” Biden said. “We have to raise the debt limit, in part, because of the reckless tax and spending policies under the previous Trump administration.”

Failure to raise the debt limit will “undermine the safety of U.S. Treasury securities, and it will threaten the reserve status of the dollar,” Biden said. “America’s credit rating will be downgraded — interest rates will rise for mortgages, auto loans, credit cards.”

Biden said he can’t guarantee the U.S. will not exceed the debt limit. “If I could, I would, but I can’t,” he said. “That’s up to Mitch McConnell.”

McConnell and his Senate minority have declined to allow Democrats to use their slender majority to raise the debt limit, insisting that they use a complicated and protracted budget process known as reconciliation.

“We don't have time to delay with elaborate procedural schemes which Republicans proposals require — scores of votes without any certainty at all, many of which have nothing to do with the debt limit at all,” Biden said.

Months before the current partisan deadlock, investors seeking safety at a time of market turmoil showed less eagerness to buy U.S. Treasury debt, according to the Institute of International Finance (IIF).

“For a few scary days in early March 2020 – at the height of the first COVID-19 wave — U.S. Treasuries stopped trading like a safe haven asset, with 10-year yield shooting up as the [Standard & Poor’s 500 Index] was tumbling,” IIF said in a report.

“In subsequent weeks, it took $1.5 trillion in emergency QE [quantitative easing] by the Federal Reserve to stabilize the market, in what has now been written off as a market ‘plumbing’ episode,” the institute said. “But this episode has many things in common with any number of EM [emerging market] crises: leverage to boost carry; a large, unexpected shock; and liquidity that evaporates when it is most needed.”