The roads are paved with receipts - just ask any automaker! Managing cash flow is crucial in any industry, but it's ‘put the pedal to the metal’ in the automotive sector.

With huge outlays required to develop new models, keep massive production lines rolling, and meet the payment demands of dealers and customers, the financial health of automakers depends on how efficiently they can accelerate cash through their receivables.

In this article, we'll take the keys and put some of the biggest industry players under the microscope to analyze their receivables report card. We'll check the odometer on key AR metrics to see who's cruising in the fast lane of cash flow and who needs to shift gears.

Buckle up for some lively numbers as we take a lap around the receivables metrics track - it's sure to be a wild ride! By the time we reach the finish line, you'll have a raring engine of insights into how the auto giants are fueling their finances.

Auto industry exceeds $104 Billion in revenue in 2023

Let’s explore the revenue insights of the automotive industry in the United States over the past five years (2019 - 2023):

Revenue Trends:

- In 2021, U.S. car and parts dealers generated an impressive $1.53 trillion in revenue from road vehicle and parts retail trade. This robust performance indicates a swift recovery from the impact of the COVID-19 pandemic.

- However, the industry faces challenges such as the global automotive chip shortage and rising raw material prices. These factors have affected the monthly inventory-to-sales ratio since April 2020, with a sluggish recovery observed since then.

Market Size:

- The U.S. automobile manufacturing industry remains substantial, with a 2023 market size exceeding $104 billion in revenue.

- American manufacturers currently produce approximately 10 million units annually, a decline from historic highs seen in the 1970s and early 2000s when production reached 13-15 million units.

Global Trends:

- Globally, vehicle sales have grown by nearly 12% year-over-year through March 2023. Supply shortages, including semiconductor chips, have moderated across many regions.

- Notably, Chinese customers rushed to buy new cars before certain tax incentives ended in April, and Western European markets experienced year-over-year growth for the first time since.

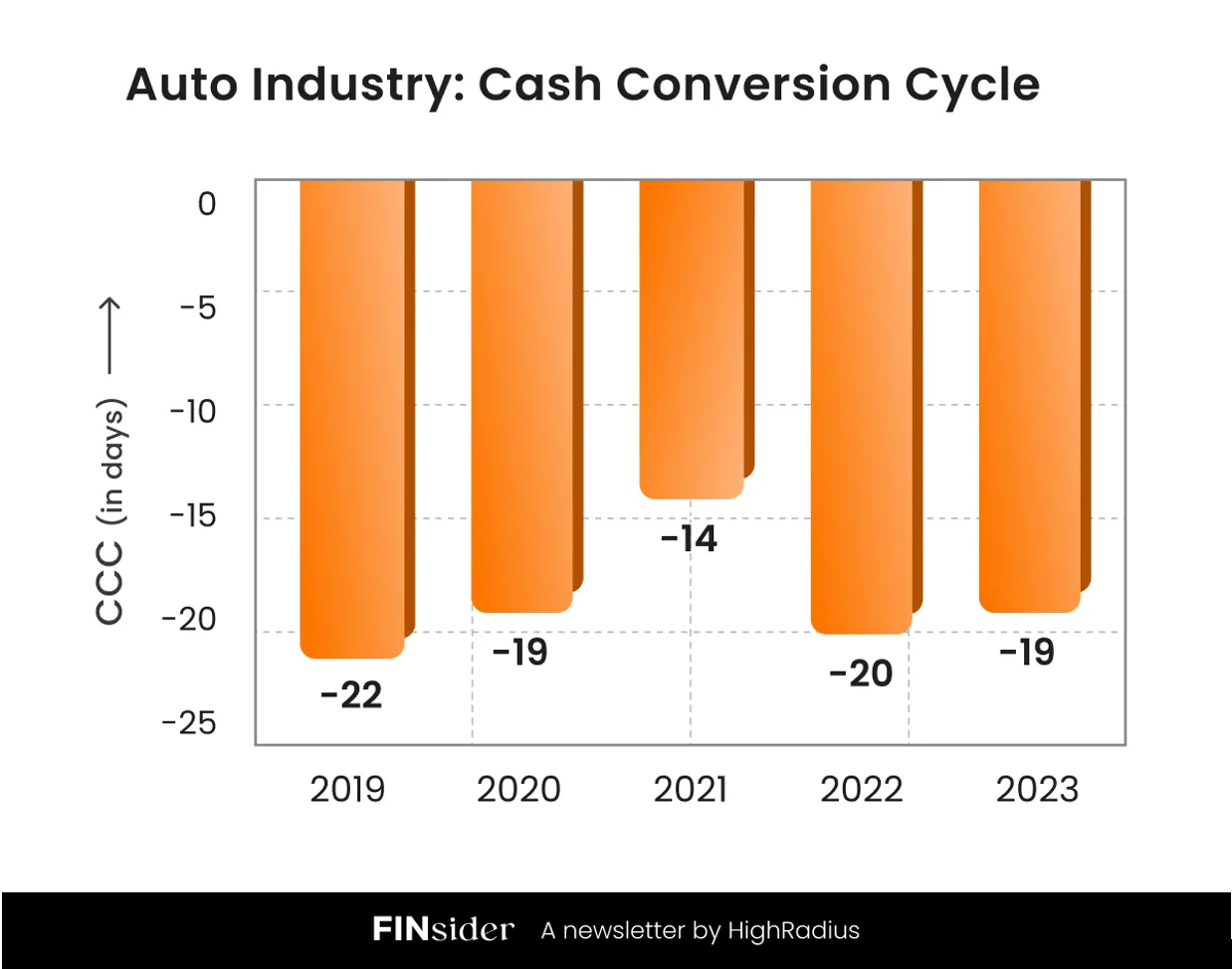

Cash Conversion Cycle reduced by 14%

Over the past five years, the automotive industry has maintained a robust management of its Cash Conversion Cycle (CCC), with an average CCC of -19 days. This consistency emphasizes the sector's adeptness at quickly turning inventory into cash, indicative of high operational efficiency and financial agility.

The industry's performance, particularly the -14% change in CCC from 2019 to 2023, suggests a strategic adaptation to market dynamics, achieving stability even amidst fluctuating economic conditions.

By 2023, with a CCC of -19 days, the industry demonstrated its resilience, effectively navigating post-pandemic challenges to stabilize its cash flow management. This reflects not only a recovery to pre-pandemic levels of efficiency but also an ability to adapt to new operational realities.

Now, let's delve into the specific metrics—Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), and Days Inventory Outstanding (DIO)—to understand better what drove these CCC scores.

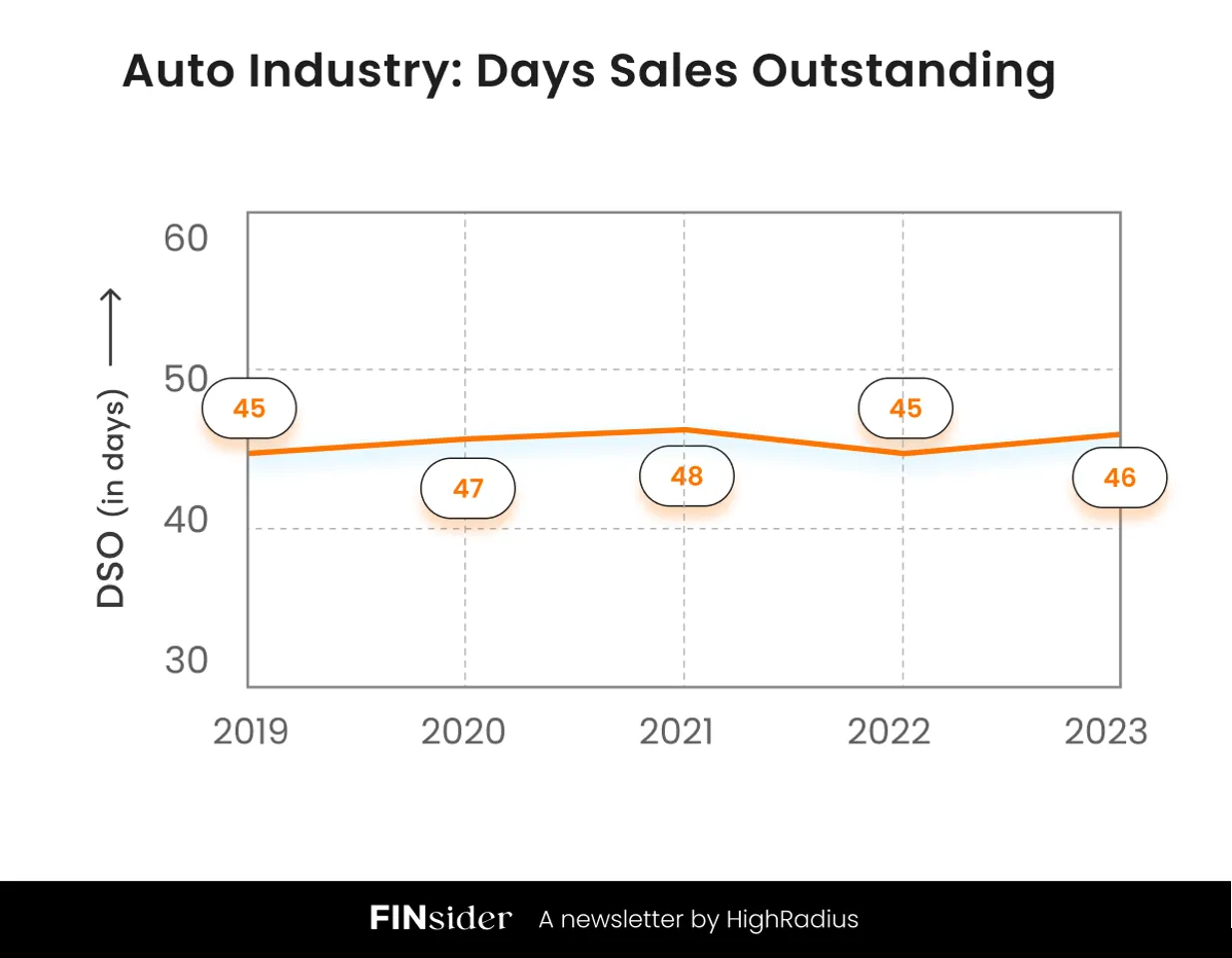

Industry Average DSO is stable at 46 days

Over the past five years, the automotive industry's Days Sales Outstanding (DSO) has shown minor fluctuations, indicating stable management of receivables, with an average DSO of 46 days.

- This consistency underscores the industry's ability to efficiently collect payments efficiently, crucial for maintaining liquidity and operational efficiency. The slight increase in DSO during 2020 and 2021 to 48 days likely reflects the economic impact of the global pandemic, with the industry adapting quickly to return to more typical levels by 2023.

- The return to a 46-day DSO in 2023, mirroring the five-year average, signals a stabilization in the industry's financial operations post-pandemic. This stability in cash flow management is essential for the automotive sector, enabling companies to effectively plan and invest in their operations.

The automotive industry's DSO stability over the past five years can be attributed to two specific strategies:

Digital and Direct Sales Models: Automakers, like Tesla, have shifted towards digital sales and direct-to-consumer approaches. This model speeds up transactions and payment processes, contributing to DSO stability by reducing the time from sale to cash collection.

Just-In-Time (JIT) Inventory Practices: Widely adopted by major players like Toyota, JIT inventory strategies minimize stock levels and align production closely with sales. This ensures faster vehicle sales and quicker receivable turnovers, stabilizing DSO by streamlining the path from production to payment.

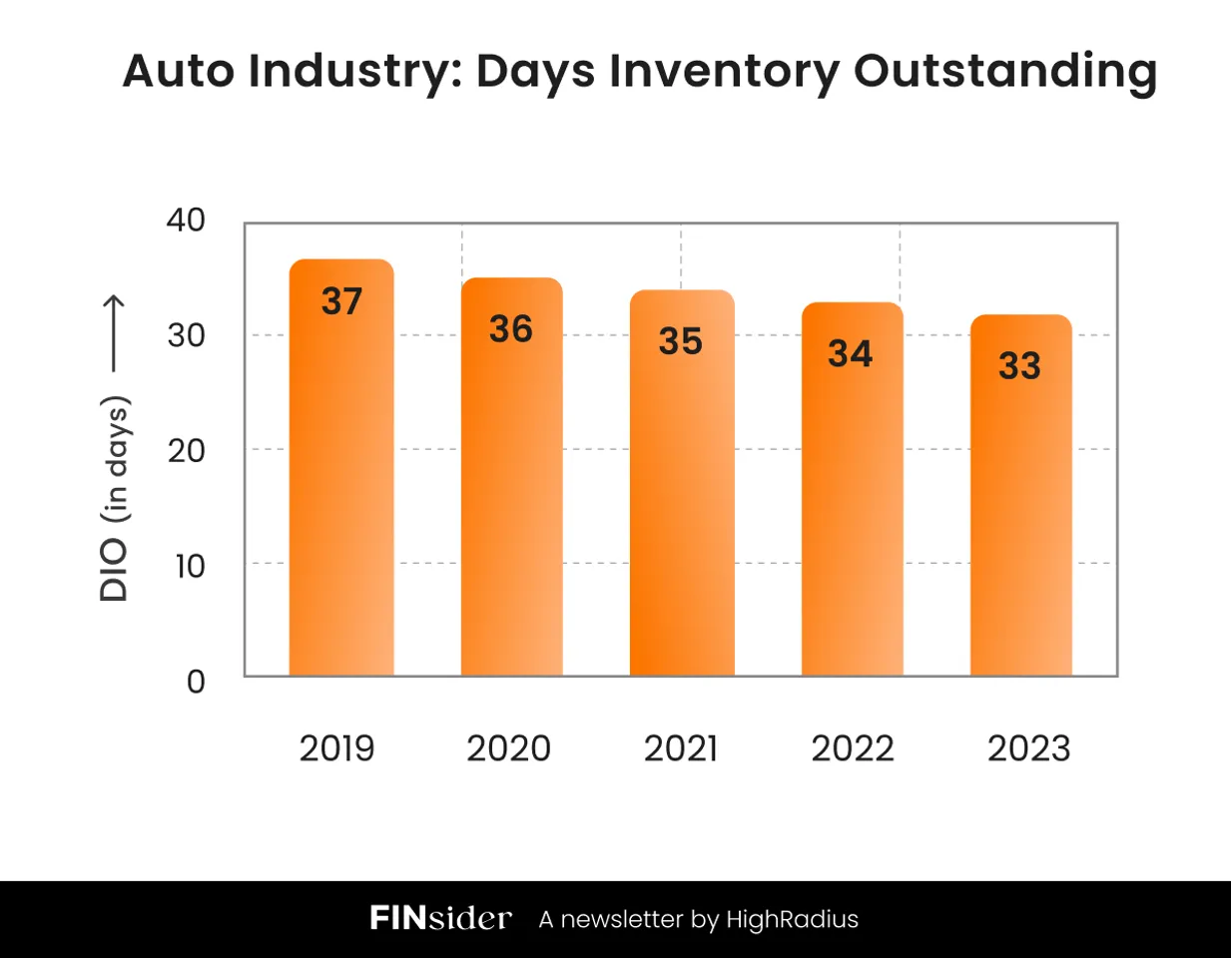

Inventory Days reduced by 11%

Over the past five years, the automotive industry has steadily improved its Days Inventory Outstanding (DIO), decreasing from 37 days in 2019 to 33 days in 2023.

This -11 % change signifies the industry's commitment to enhancing inventory efficiency, crucial for reducing costs and freeing up capital.

An average DIO of 35 days reflects successful efforts in optimizing inventory management and aligning production with demand, despite challenges like supply chain disruptions.

In 2023, the industry's achievement of a 33-day DIO, the lowest in the observed period, illustrates advanced inventory strategies and a shift towards more resilient supply chain practices.

The auto industry's reduction in inventory days can be linked to two specific operational adjustments:

Product Lineup and Manufacturing Optimization: Automakers, like General Motors, have streamlined their offerings, focusing on high-demand models such as SUVs and EVs, and optimized their manufacturing footprint by closing less efficient plants. This strategic realignment towards market preferences and flexible manufacturing reduces unnecessary inventory, lowering inventory days.

Region-specific Inventory Strategies: Automaker companies implement tailored inventory management for different markets, addressing unique demand patterns and logistical challenges. This approach minimizes inventory levels by closely aligning supply with local demand, further reducing inventory days across global operations.

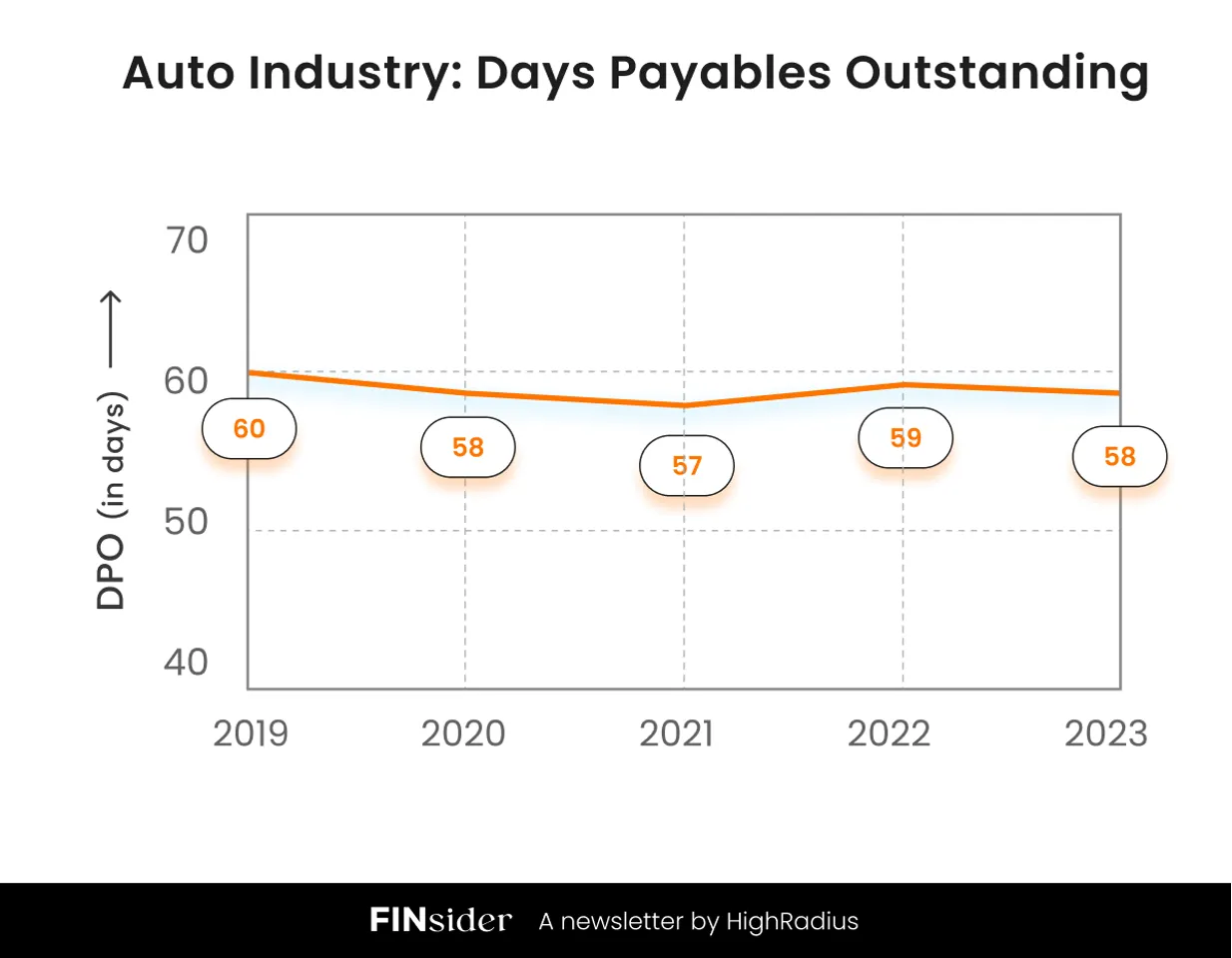

Average Payment Term is 58 Days

The automotive industry has demonstrated consistent management of its Days Payables Outstanding (DPO) from 2019 to 2023, with a slight decline from 60 days to 58 days, reflecting a -3.33% change.

This indicates a stable yet slightly tightening approach to handling payments to suppliers, balancing cash flow optimization with maintaining supplier relationships.

The industry average DPO at 58 days underscores a strategic focus on efficient cash management, crucial for sustaining operations and growth amidst supply chain complexities.

The consistency observed in 2023, with the DPO aligning with the five-year average, points to the sector's strategic financial planning and its resilience against economic shifts.

The automotive industry's DPO reduction over the past five years could be attributed to two specific factors:

Strategic Supplier Consolidation: Automakers like Ford have been streamlining their supplier networks, focusing on fewer, more dependable partners to improve negotiation leverage and secure better payment terms, leading to shorter payment cycles. This approach helps maintain strong supplier relationships and optimize cash flow by ensuring timely payments, crucial for supply chain stability.

Impact of Financial Policy Changes and Economic Conditions: Fluctuating interest rates and economic uncertainties, including trade tensions, have prompted companies to adjust their payment strategies. Rising interest rates encourage paying suppliers earlier to capture discounts or mitigate costs, while economic challenges drive efforts to maintain liquidity and minimize financial risks by reducing payables days.

From Showrooms to Stockrooms: Automakers are in the driver's seat of Cash flow

The automotive industry has demonstrated its ability to navigate financial challenges and accelerate cash flow management. Despite potential obstacles, the sector has shifted into high gear when it comes to financial performance.

OEMs and suppliers have optimized their financial management strategies, from inventory control to payment collection. Strong receivables metrics are fueling innovation, providing the necessary resources for continued growth and development in the industry.

To further enhance Accounts Receivable processes, businesses can learn from industry leaders such as Tesla, GM, and Toyota. Implementing cloud-based AR software, like HighRadius, can automate and streamline financial workflows, improving operational efficiency and working capital management.

Interested in staying updated on the latest financial insights about Fortune 500 companies? Subscribe to FINsider and receive monthly updates delivered directly to your inbox.