Most finance systems are built on two assumptions:

- People work in the country your office is in.

- That won’t change anytime soon.

Both are wrong. (And if they weren’t, global payroll wouldn’t be so messy.)

Global hiring has flipped those assumptions on their head. You now have data scientists in Nairobi, marketing leads in Berlin, and contractors in Jakarta — none of them tied to a central HQ, all of them critical to your bottom line.

And yet, your cost centers still treat geography as a fixed point.

As if borders still define how work gets done.

They don’t. Not anymore.

You’re not running a local business. So why is your finance stack acting like it?

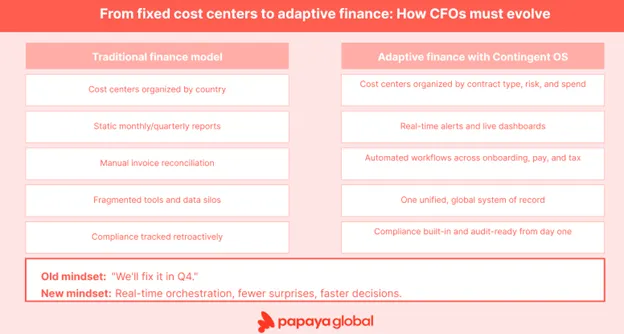

Cost centers, classification logic, approval flows — most were built when your workforce lived in one country, with full-time contracts and payroll cycles. Now? You’re stitching together a matrix of full-timers, freelancers, agencies and platforms. Each with their own tax risk, contract structure and payment model.

And the tools you're using? Still asking for "cost center by country." That’s not visibility. That’s a slow-motion mess.

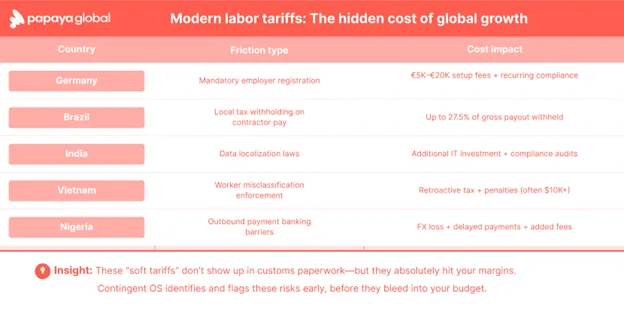

Tariffs used to apply to goods. Now they apply to labor.

There’s a quieter kind of tariff happening... on people. You won’t see it on a shipping manifest, but you’ll definitely feel it in your margins.

Countries are introducing soft restrictions that create real cost friction:

- Limits on contractor usage

- Mandatory employer registration

- Local tax authority withholding rules

- Banking barriers for outbound payments

- Data localization and permanent establishment risks

It’s easy to miss until it hits your margins.

That new dev team in Vietnam? Great rate, wrong classification — and suddenly you're back-paying taxes with a side of penalties.

Translation: you can’t just spin up a team and hope for the best.

You can’t forecast global growth without factoring in these new labor tariffs. And if your financial model can’t surface them early, it’s not a model. It’s a liability.

AI doesn’t just automate — it recalibrates how finance makes decisions

This is where AI stops being a buzzword and starts being a lifeline.

Today’s workforce data is too complex, too fragmented and too fast-moving for humans to manually reconcile. You need systems that can:

- Flag classification risk before an invoice gets paid

- Forecast regulatory exposure in shifting markets

- Spot gaps in onboarding or missing documentation

- Detect changes in payment behavior or FX volatility

At Papaya Global, AI helps us bring all of this into view. Not as a report next quarter, but as a signal today. Because “we’ll fix it in Q4” isn’t a plan. It’s a delay.

That’s adaptive finance. And it’s the only kind that works across 160+ countries, dozens of worker types and a real-time business rhythm.

Why we built Contingent OS — and why finance needs it

We didn’t set out to build another workforce tool. We built Contingent OS because the infrastructure to manage today’s workforce simply didn’t exist.

Managing a global contingent workforce (aka “extended workforce”) used to mean stitching together seven different systems; one for onboarding, another for classification, a third for payments, and so on, while hoping nothing broke in the handoffs. There was no single platform that could classify, onboard and pay every type of worker: contractor, EoR, agency-sourced, freelance, hybrid—across every jurisdiction, with full compliance and real-time visibility.

So we built the one we needed.

Contingent OS is a unified platform that brings together everything required to manage a global, flexible workforce:

- Self-serve onboarding and standardized workflows

- Real-time worker classification logic, backed by in-country legal experts

- Same-day global payments to over 160 countries

- Built-in compliance workflows with audit-ready documentation

- Live analytics and AI-powered alerts for visibility and control

For finance leaders, this means fewer unknowns, faster decisions, and a smoother close every month. No more reconciling disconnected spreadsheets or uncovering misclassified contractors during a tax audit. Instead, you get real-time control over workforce spend, compliance and risk, all from a single source of truth.

Contingent OS is the financial infrastructure your workforce strategy has been missing.

From ownership to orchestration

The role of finance has changed to orchestrating systems that adapt, inform and support the business at scale.

The teams that get this right are winning. They’re moving faster, managing risk earlier and building with clarity instead of just control. And the ones still organizing spend by country code? They’re being left behind — one misclassified invoice at a time. And to them I say, “Good luck when that invoice gets flagged in audit season.”

Borders aren’t how work gets done anymore. They’re just where the paperwork gets delayed.

If your finance infrastructure still sees the world as static, it’s time to upgrade. Papaya’s Contingent OS is built for the way work actually works.