Compliance: Page 17

-

FASB mulls two new software accounting options

The project to improve software accounting standards is a long time coming. At least one element of the current standards has remained largely unchanged since 1985.

By Maura Webber Sadovi • Jan. 19, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

US to jack up fees for big mergers

Filing fees are expected to soar this year and companies will need to prepare for increased regulatory scrutiny of M&A deals.

By Alexei Alexis • Jan. 18, 2023 -

Explore the Trendline➔

Explore the Trendline➔

the-lightwriter via Getty Images

the-lightwriter via Getty Images Trendline

TrendlineTop 5 stories from CFO Dive

The promises and traps of generative AI, revamped modern finance teams and stark geopolitical risks are among the top forces CFOs are grappling with this year.

By CFO Dive staff -

SEC aims to set climate risk, cybersecurity rules before May

The agency, laying out an ambitious agenda, aims in early 2023 to complete several new regulations, many of them focused on increasing disclosures for investors.

By Jim Tyson • Jan. 17, 2023 -

‘Scope creep’ challenging audit committees: CAQ

Audit committees are taking on more responsibilities as the SEC writes several rules requiring more detailed corporate disclosure.

By Jim Tyson • Jan. 13, 2023 -

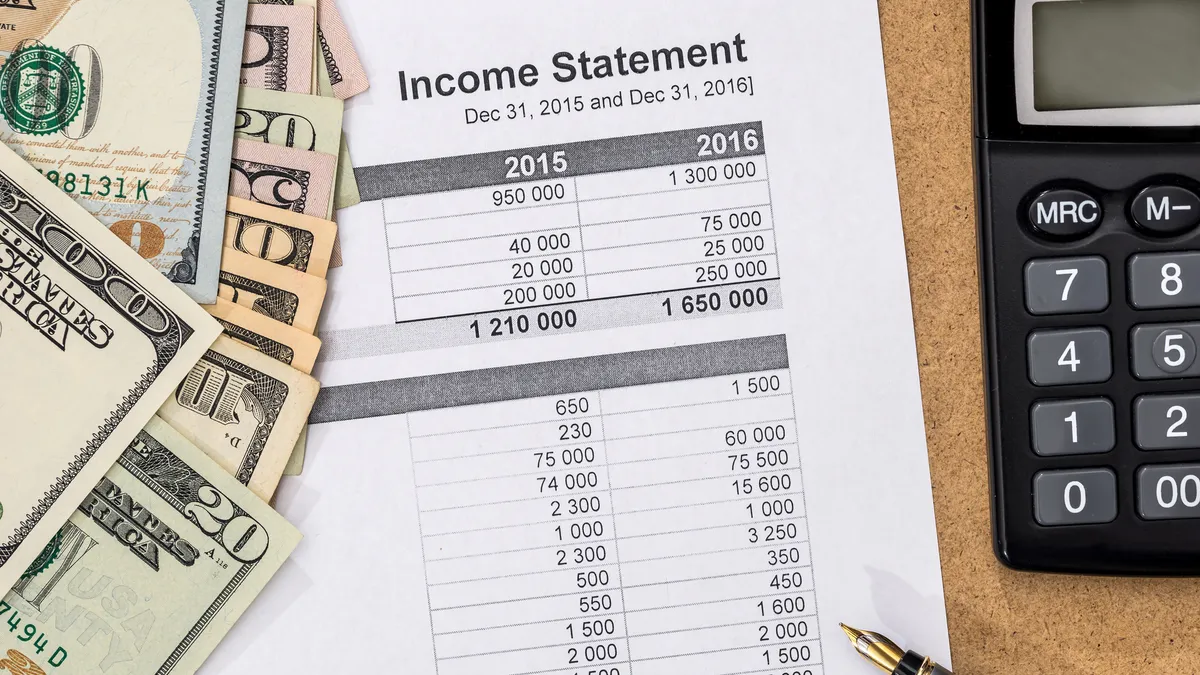

FASB decides to require expense disclosures

For investors, the new income statement disclosure project is the FASB’s most important initiative “by a factor of ten,” one board member said. But it will mean added costs for companies.

By Maura Webber Sadovi • Jan. 11, 2023 -

Trump ex-CFO sentenced to five months for tax fraud

The sentencing comes about one month after a jury convicted two Trump Organization affiliates of tax fraud and other crimes. The company’s former CFO testified for the prosecution during the trial.

By Grace Noto • Jan. 10, 2023 -

FASB continues push for corporate expense disclosures

As the FASB kicks off its first meeting of the new year Wednesday, the U.S. standard setter faces external pressure to step up the pace of its process.

By Maura Webber Sadovi • Jan. 9, 2023 -

Deep Dive

4 CFO trends to watch in 2023

Fed efforts to curb inflation, an imbalance in the demand and supply of workers and clarification of accounting standards are among the CFO trends this year.

By Jim Tyson , Maura Webber Sadovi • Jan. 6, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Non-competes would be illegal under FTC’s proposed rule

If finalized as written, both new and existing non-competes, along with some non-disclosure agreements, would be banned as unfair practices that harm competition.

By Robert Freedman • Jan. 5, 2023 -

SEC charges ex-CFO at gold mining SPAC with $5M fraud

The embezzlement allegations follow the collapse of the SPAC market in 2022 and sharper SEC scrutiny of the so-called blank check companies.

By Jim Tyson • Jan. 4, 2023 -

IRS delivers ‘crucial guidance’ on 15% minimum tax

The interim guidance gives tax preparers some key directions for interpreting the 15% Corporate Alternative Minimum Tax. But more questions remain, experts say.

By Maura Webber Sadovi • Jan. 3, 2023 -

SEC commissioner opposes ‘ballooning’ PCAOB budget

The PCAOB has stirred up criticism since SEC Chair Gary Gensler shook up its leadership and called for sharper regulation of the firms that audit public companies.

By Jim Tyson • Jan. 3, 2023 -

How GCs can prevent universal proxy cards from disrupting strategy

The impact of the SEC’s new director voting system remains to be seen, but a legal leader’s role in consensus-building is clear.

By Robert Freedman • Jan. 3, 2023 -

Shifting retirement plan climate calls for CFO attention: WTW

As resources to fund retirement plans are expected to grow scarcer next year, companies must be nimble and share a clear vision when shaping retirement plan offerings.

By Elizabeth Flood • Dec. 20, 2022 -

‘Bleisure’ travel pays off in ROI

Combining business and leisure travel may lead to employee retention, according to Hilton executives.

By Elizabeth Flood • Dec. 16, 2022 -

New CFO shares first-timer tactics

Jeremy Klaperman advises new CFOs to establish a wide range of connections and to seek potential over knowledge when hiring talent.

By Elizabeth Flood • Dec. 15, 2022 -

PCAOB gains breakthrough access to Chinese audit firms

The PCAOB’s push for more transparency in China-based companies will enable CFOs and auditors who heavily rely on Chinese firms to better understand their partners’ operations.

By Maura Webber Sadovi • Dec. 15, 2022 -

FASB forges ahead on crypto disclosure requirements

The board was effectively silent on the collapse of crypto exchange FTX last month but it forged ahead on its ongoing project to set new standards for digital assets.

By Maura Webber Sadovi • Dec. 14, 2022 -

Trump case spells benefits’ tax perils

Underreporting “fringe benefits” has long been on the IRS’ radar but there appears to be a shift toward holding companies more accountable for tax reporting.

By Maura Webber Sadovi • Dec. 14, 2022 -

DOJ, SEC charge Sam Bankman-Fried with defrauding investors

Former FTX CEO Sam Bankman-Fried was arrested Monday night in the Bahamas and charged Tuesday with eight criminal counts including wire fraud.

By Gabrielle Saulsbery • Dec. 13, 2022 -

Shoddy ESG data stymies 35% of senior executives: Deloitte

CFOs have redoubled efforts to measure sustainability as the SEC completes a rule requiring disclosure of climate risks.

By Jim Tyson • Dec. 12, 2022 -

Tyson Foods backs CFO after reviewing arrest

The meat processing giant’s pick of John R. Tyson — the great grandson of the company’s founder — has drawn skepticism from some board governance experts.

By Elizabeth Flood • Dec. 9, 2022 -

SEC calls for disclosure on crypto risks, citing ‘financial distress’

The collapse of FTX has slammed scores of creditors, prompting SEC concerns that companies may suffer losses from direct or indirect links to crypto markets.

By Jim Tyson • Dec. 9, 2022 -

Opinion

3 reforms for the post-FTX crypto era

FTX’s collapse underscores the highly-centralized crypto market’s risks and blockchain’s importance as a defense against bad actors, Metallicus' CFO argues.

By Irina Berkon • Dec. 9, 2022 -

PCAOB warns of uptick in auditing flaws

To avert flaws in reports, CFOs should keep auditors apprised of any big changes or new business risks and invest in internal controls.

By Maura Webber Sadovi • Dec. 8, 2022