Compliance: Page 29

-

Petition details Trump Organization valuation practices

A property the company bought in 1995 for $7.5 million was valued at almost $300 million in 2014, even though a plan for luxury home development was still in the starting gate, the document shows.

By Robert Freedman • Jan. 20, 2022 -

Antitrust officials will update M&A rules for technology, other sectors

The Federal Trade Commission and Department of Justice say current M&A guidelines may lag changes in technology-driven markets.

By Jim Tyson • Jan. 19, 2022 -

Interest deduction, R&E changes could raise 2022 tax bill

Finance leaders will need to determine how two provisions in the 2017 Tax Cuts & Jobs Act that take effect this year will impact their operations, says a tax specialist.

By Robert Freedman • Jan. 10, 2022 -

Executive tried to create appearance of market interest to raise company valuation, SEC says

Andrew Murstein replaced Medallion Financial’s use of book value with fair market value as a first step in making a subsidiary’s worth seem higher than it was.

By Robert Freedman • Jan. 7, 2022 -

Was CFO absence at Theranos a warning sign?

Investors poured some $1.5B into Elizabeth Holmes' blood-testing startup despite the absence of a finance chief.

By Robert Freedman • Jan. 4, 2022 -

17 states back court challenge to Nasdaq board diversity rule

A Nasdaq rule endorsed by the SEC and aimed at promoting diversity on corporate boards is a “crude and odious” example of discrimination, state attorneys general said.

By Jim Tyson • Jan. 4, 2022 -

Nikola fined $125M for founder's exaggerations

Former CEO and Chair Trevor Milton is subject to a separate action that coud result in millions of dollars in disgorgment and penalties if claims succeed.

By Robert Freedman • Dec. 21, 2021 -

Regulators warn of legal risks to companies that botch LIBOR transition

“More work remains to be done” on the imminent phase-out of LIBOR to reduce the risk of market instability, Treasury Secretary Janet Yellen said.

By Jim Tyson • Dec. 17, 2021 -

SEC proposes enhanced buyback disclosures

Companies must let investors know why they’re executing a repurchase program and how they determined the amount of shares involved, among other things.

By Robert Freedman • Dec. 15, 2021 -

SPACs could face more restatements because of equity classification

In a high-profile case, the sponsor of WeWork, BowX, is restating its past year’s financials to correct for classifying a portion of its shareholder equity as permanent, rather than as temporary.

By Robert Freedman • Dec. 10, 2021 -

Finance execs said to manipulate 'topsides' to inflate revenue

American Renal Associates’ former CFO, CAO and controller reconciled estimated vs. actual revenue based on performance goals, not patient-level data, the Securities and Exchange Commission charged.

By Robert Freedman • Dec. 7, 2021 -

Tax teams face year-end 1099 reporting changes

Reporting on non-employee compensation must be done using 1099-NEC, a form used last year for the first time since the early 1980s.

By Robert Freedman • Dec. 6, 2021 -

Former pharma CFO charged with insider trading

Usama Malik violated a blackout period to share news of a favorable development with people who profited from it.

By Robert Freedman • Dec. 3, 2021 -

SEC to give 'spring-loaded' stock awards close scrutiny, memo suggests

It's less the timing than the valuation that the Securities and Exchange Commission is concerned about when companies give out stock awards right before a big announcement.

By Robert Freedman • Dec. 1, 2021 -

Risks rise as COVID-19 compels companies to weaken due diligence: Refinitiv

The coronavirus has permanently broadened the risk landscape beyond financial crime, confronting CFOs with challenges that encompass environmental and social concerns.

By Jim Tyson • Nov. 29, 2021 -

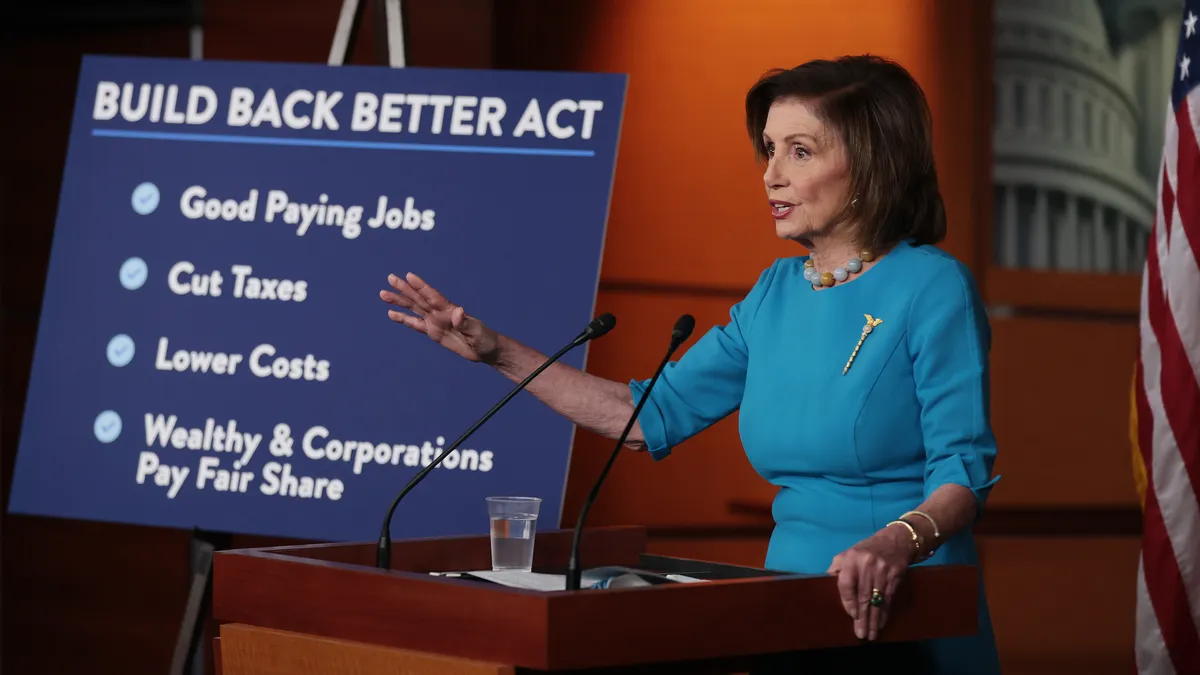

Little for CFOs to like in Build Back Better tax provisions

Even if the Senate softens the legislation, companies can expect to see more complicated tax compliance, especially if they operate globally.

By Robert Freedman • Nov. 29, 2021 -

697 companies hit with SEC violations in FY 21

GE, Kraft-Heinz, Robinhood, AT&T and Ernst & Young were among companies charged by the Securities and Exchange Commission.

By Robert Freedman • Nov. 24, 2021 -

U.S. House panel passes bills tightening SPAC oversight

Two bills approved by the House Financial Services Committee signal support from lawmakers for tougher SEC regulation of SPACs.

By Jim Tyson • Nov. 17, 2021 -

SEC awarded record $564M to whistleblowers this fiscal year

The Securities and Exchange Commission in fiscal 2021 awarded more money to more people than in any year since its whistleblower program was authorized in 2010.

By Robert Freedman • Nov. 16, 2021 -

Opinion

Recurring billing increases sales tax complexity

Organizations new to the subscription model could be surprised by the tax risk they create when they generate more of their sales on a recurring basis.

By Mike Beach and Liz Armbruester • Nov. 16, 2021 -

Photo by MART PRODUCTION from Pexels

Most big companies fail to fully detail board diversity despite SEC pressure

Even after pledging greater transparency, most large companies do not provide details on workforce diversity, a survey found.

By Jim Tyson • Nov. 15, 2021 -

Flaws high in work by small audit firms: PCAOB

Small audit firms have failed to overcome weaknesses as quickly as their larger rivals, the PCAOB’s acting chair said.

By Jim Tyson • Nov. 10, 2021 -

SEC staff veteran to head up audit watchdog PCAOB

Erica Williams cut her teeth at the staff level of the Securities and Exchange Commission then served as an advisor in the Obama White House on financial issues.

By Robert Freedman • Nov. 9, 2021 -

Audit overseer gets teeth to seek Chinese cooperation on U.S.-listed companies

The SEC approved a framework by the Public Company Accounting Oversight Board for assessing whether jurisdictions are letting the watchdog check the audit quality of U.S.-listed foreign companies.

By Robert Freedman • Nov. 8, 2021 -

CFOs face far tougher federal financial oversight under Biden, attorneys say

A Department of Justice white-collar crime initiative will put companies and their finance teams under the spotlight in a way they weren’t under the Trump administration.

By Ted Knutson • Nov. 5, 2021