Compliance: Page 34

-

SPAC warrant resolution said to be in works

Legal and accounting specialists are developing a type of warrant that can be treated as equity, but it’s weeks away and needs SEC approval.

By Robert Freedman • May 17, 2021 -

Trump CFO probe continues with school tuition subpoena

The subpoena seeks information regarding tuition payments to Columbia Grammar & Preparatory School, where Trump Organization CFO Allen Weisselberg’s grandchildren are enrolled.

By Jane Thier • May 14, 2021 -

Bill seeks to shine light on companies' global profit shifting

The "Disclosure of Tax Havens and Offshoring Act" would require companies to identify their profits and taxes on a country-by-country basis.

By Robert Freedman • May 12, 2021 -

As SEC ramps up SPAC rules, lawsuits could follow

The Securities and Exchange Commission is expected to step up scrutiny of special purpose acquisition companies. If it does, sponsors and investors could start challenging it in courts, a former SEC commissioner says.

By Robert Freedman • May 10, 2021 -

ESG reporting

Companies ignoring ESG may become 'uninvestable,' says investment bank chief

Interest in sustainability goals is growing "enormously" and companies that ignore the trend risk rejection by investors, according to Larry Wieseneck, co-president of investment bank Cowen.

By Jim Tyson • May 7, 2021 -

Corporate tax rate unlikely to rise above 25%

Along with the tax hike, mandatory ESG reporting and the treatment of remote workers are priorities that stand a good chance of congressional passage this year, a lobbyist for the accounting profession says.

By Robert Freedman • May 7, 2021 -

Trump CFO Weisselberg on shaky ground by claiming ignorance

Although CFOs aren’t expected to make legal decisions, they don’t have the luxury of a "don’t ask, don’t tell" approach, legal specialists say, because the financial and legal sides of complex issues are intertwined.

By Ted Knutson • May 6, 2021 -

PPP runs out of funds for most lenders

About $8 billion remains available through MDIs and CDFIs, the Small Business Administration told banking trade groups Tuesday. But the portal has largely stopped accepting applications, the American Bankers Association said.

By Dan Ennis • May 5, 2021 -

Under Armour hit with $9M fine for undisclosed 'pull forwards'

The company accelerated revenue without disclosing material information to investors about the practice, the Securities and Exchange Commission says.

By Robert Freedman • May 4, 2021 -

ESG investing fails to outperform: study

ESG investing offers neither superior returns nor risk protection, and investors seeking outperformance are looking “in the wrong place,” a Scientific Beta study finds.

By Jim Tyson • May 4, 2021 -

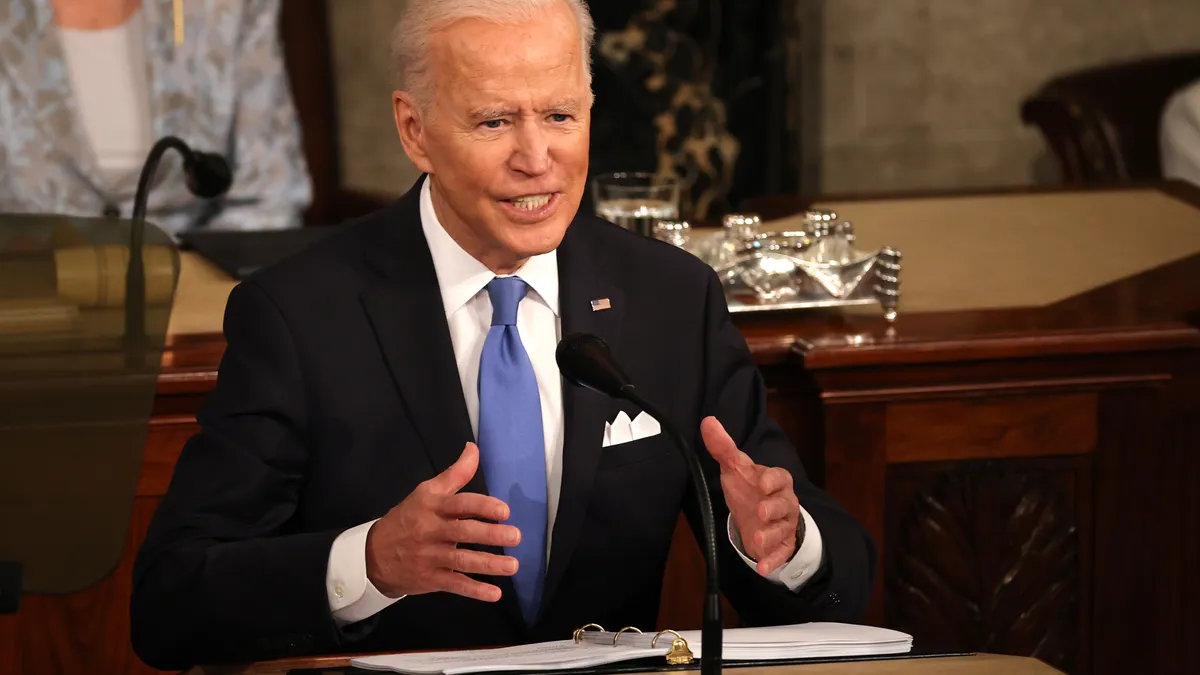

Retrieved from The White House.

Retrieved from The White House.

Corporate inversions could return under Biden tax plan

Despite hurdles, companies could merge with a smaller foreign company and relocate outside the U.S. to avoid a big tax bite.

By Robert Freedman • May 4, 2021 -

SEC hits companies for hiding restatements before seeking filing delays

The agency used data analytics to identify companies that sought a filing delay and then shortly afterward announced a correction to a previous filing.

By Robert Freedman • May 3, 2021 -

Biden climate policy poses credit risks for 'carbon-intensive' companies: Moody's

Biden administration plans for curbing climate change will increase credit risks for companies in carbon-intensive industries while creating business opportunities, Moody’s said.

By Jim Tyson • April 30, 2021 -

Multinationals reported $6.16B in negative forex exposure for Q4: study

A decline in negative foreign exchange impact during the fourth quarter was probably "the calm before the storm" that likely occurred during the first quarter of 2021, according to Kyriba.

By Jim Tyson • April 29, 2021 -

SEC said to be weighing SPAC disclosure guidelines

Whether or not guidance is issued, the agency is signaling concerns over "frothy" forward-looking statements in the hot alternative IPO market.

By Robert Freedman • April 29, 2021 -

Biden tax hikes won't change company credit plans: Moody's

Companies have shown they’re impervious to tax policy changes in part because of low interest rates and investors’ hunt for yield.

By Robert Freedman • April 28, 2021 -

Retrieved from The White House.

Retrieved from The White House.

Biden plan would increase taxes on multinationals by $1.2 trillion over 10 years: study

Biden’s proposal to raise corporate taxes to fund $2 trillion in infrastructure spending would harm U.S. competitiveness, the Tax Foundation says.

By Jim Tyson • April 28, 2021 -

SPAC market during Q1 showed 'explosive growth': Duff & Phelps

The SPAC market boomed during the first quarter of 2021, Duff & Phelps said, noting that SPAC warrants this month have come under regulatory scrutiny.

By Jim Tyson • April 23, 2021 -

New SPAC scrutiny demands solid forecasts

The Securities and Exchange Commission has signaled there’s no safe harbor for merger-related forward guidance if numbers aren’t justified.

By Robert Freedman • April 20, 2021 -

Rising number of IRS corporate audits end in 'no change': tax expert

Companies have outgunned IRS auditors with high-paid accountants and attorneys, pushing up the number of audits that result in no change to tax filings, tax experts say.

By Jim Tyson • April 20, 2021 -

Democrats, Republicans finalizing draft LIBOR bill, pledging cooperation

The legislative effort to smooth the phase-out of LIBOR will test whether the two parties can cooperate in heeding warnings from regulators of systemic risk.

By Jim Tyson • April 19, 2021 -

FASB passes change on sales-type day-one lease losses

The change aligns with what was in place before the accounting standards board made sweeping changes to the treatment of leases under ASC 842.

By Robert Freedman • April 16, 2021 -

Deep Dive

SEC cybersecurity tactics point to ESG approach, attorney says

As the Securities and Exchange Commission builds investor protections on sustainable investing, CFOs can look to the agency's approach to cybersecurity for hints on how to prepare for disclosure rules and enforcement actions.

By Jim Tyson • April 15, 2021 -

SEC taking hard look at SPAC warrants, disclosures

A recent flurry of federal cautionary statements signals the hands-off days of special purpose acquisition company (SPAC) IPOs are over.

By Robert Freedman • April 15, 2021 -

Senate confirms Gensler to lead SEC in 53-45 vote

While leading the Biden administration’s watchdog of Wall Street, Gensler is expected to toughen aspects of oversight that were eased during the Trump administration.

By Jim Tyson • April 14, 2021