Compliance: Page 36

-

Companies consider cheaper, faster Subchapter 5 bankruptcies

The process’s higher debt threshold opens the door to companies that would otherwise have few options besides expensive Chapter 11.

By Robert Freedman • March 2, 2021 -

US tax executives seeing more taxation disputes, survey finds

The economic fallout from the pandemic has prompted U.S. companies to alter their tax strategies and has increased disputes over taxation, according to a BDO survey.

By Jim Tyson • March 2, 2021 -

Gulfport failed to disclose perks, SEC says; CEO penalized

The gas exploration and development company avoided a fine by fixing the problem quickly, but the CEO was hit with a civil fine for causing the disclosure failures.

By Robert Freedman • March 1, 2021 -

Opinion

Making pandemic-related EBITDA adjustments

Annualized earnings, 2021 EBITDA and swap outs are three approaches CFOs are taking to show company performance potential in light of COVID-19.

By Brian Garfield • Feb. 25, 2021 -

Former KPMG auditors signed off on incomplete college financials

The SEC penalized the auditors for their unprofessional conduct in allowing the College of New Rochelle to release a financial report before completing critical audit steps.

By Robert Freedman • Feb. 24, 2021 -

Biden's corporate tax hike would reduce output, jobs, wages, study finds

Biden’s proposed increase in corporate tax would push up the U.S. federal-state combined tax rate to the highest level in the OECD, the Tax Foundation said.

By Jim Tyson • Feb. 24, 2021 -

Moriah Solomon. (2021). [Photograph]. Retrieved from Unsplash.

Moriah Solomon. (2021). [Photograph]. Retrieved from Unsplash.

Prior business relationships influence PPP coronavirus lending, study finds

Banks used the PPP last year to strengthen relations with “large connected firms,” a joint study by Washington University in St. Louis, Boston College and the University of Geneva found.

By Jim Tyson • Feb. 17, 2021 -

A financial advisor's top 5 SPAC tax issues

Identifying acquirer and predecessor entities are among decisions the tax team of the combined company must make.

By Robert Freedman • Feb. 17, 2021 -

FASB OKs more timely goodwill impairment testing

Finance teams can wait until their company’s next reporting period to test for any reduction in value.

By Robert Freedman • Feb. 15, 2021 -

"Michigan Capitol" by Michael Erwine is licensed under CC BY 2.0

"Michigan Capitol" by Michael Erwine is licensed under CC BY 2.0

Study: States cut corporate taxes despite pandemic-induced shortfalls

A plunge in tax revenue caused by the downturn in 2020 did not discourage several states from trimming corporate income taxes.

By Jim Tyson • Feb. 4, 2021 -

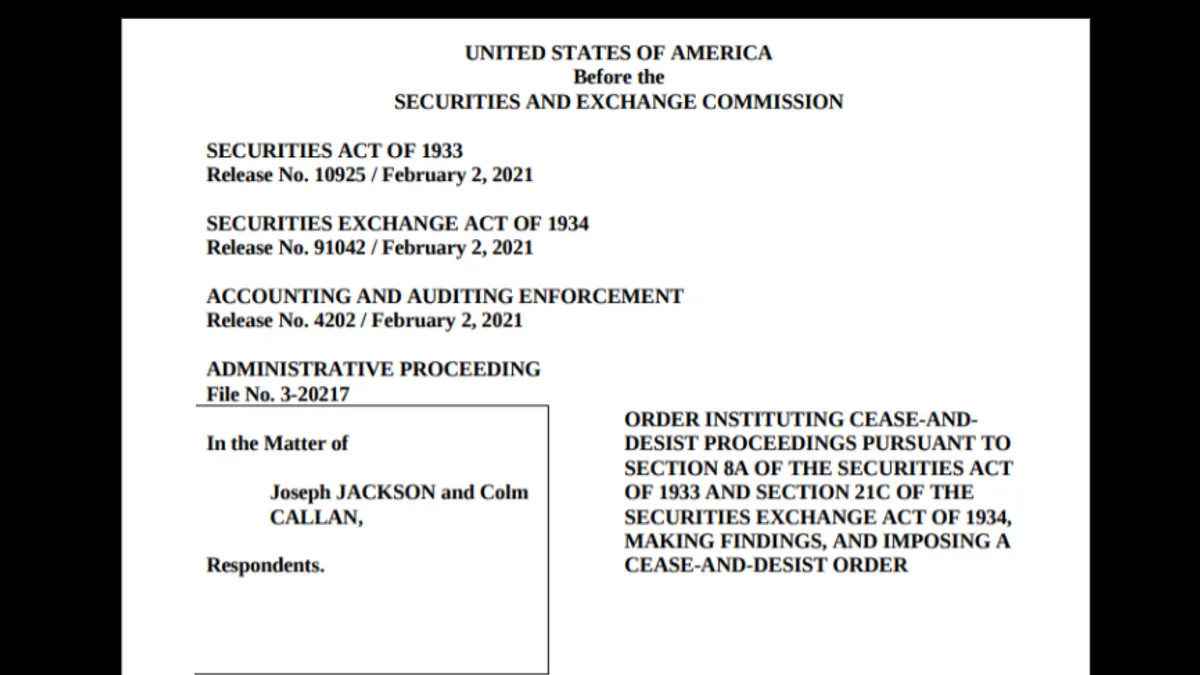

SEC. (2021). "WageWorks" [Photo]. Retrieved from SEC.

SEC. (2021). "WageWorks" [Photo]. Retrieved from SEC.

Former WageWorks CEO, CFO fined for improperly recognizing revenue

The penalty includes clawbacks of the executives’ incentive-based compensation.

By Robert Freedman • Feb. 3, 2021 -

Diverse CFOs could be heading into board-seat golden age

As companies try to meet ESG measures, and a likely Nasdaq rule, efforts to add women and minorities to boards are moving from talk to action, opening opportunities for finance executives.

By Robert Freedman • Feb. 2, 2021 -

SEC appoints policy advisor to advance new initiatives on ESG

The appointment of an ESG advisor by the acting SEC chair follows commitments by President Biden to redouble efforts to combat climate change.

By Jim Tyson • Feb. 2, 2021 -

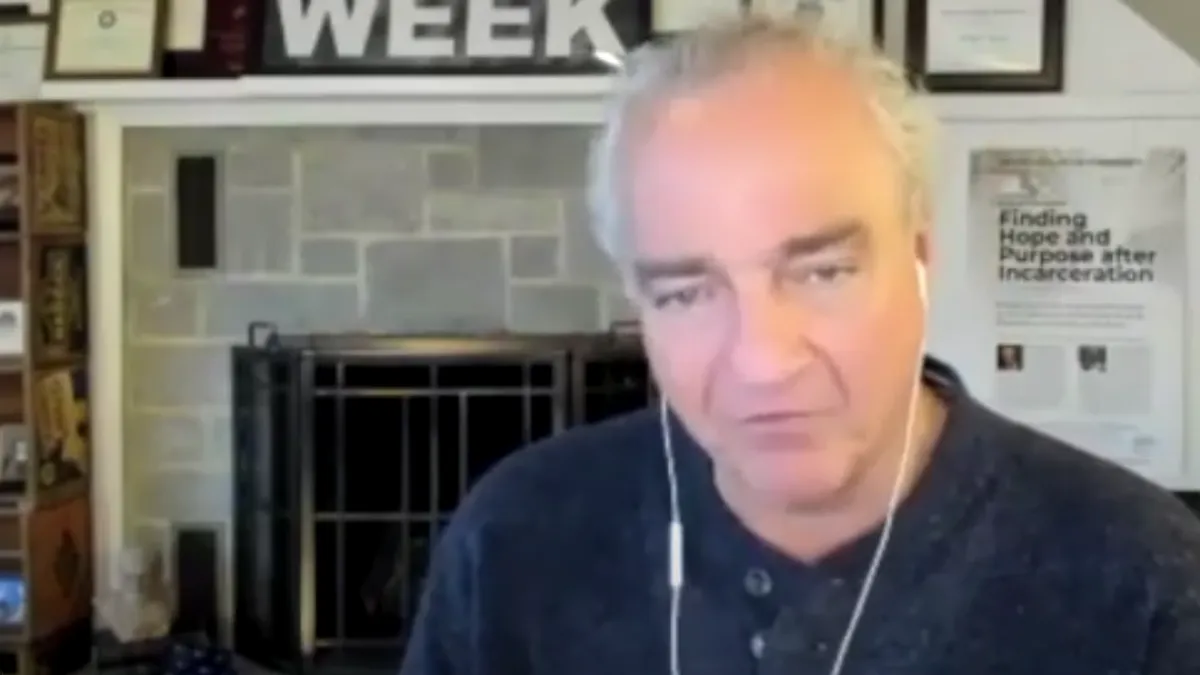

Screen grab/CFO Dive, data from White Collar Week

Screen grab/CFO Dive, data from White Collar Week

After serving time, fraudster cautions against PPP, other emergency loans

Taking money hastily can create more problems than it solves if the additional resources aren’t tethered to need.

By Robert Freedman • Jan. 27, 2021 -

Remote work, whistleblower laws poised to fuel PPP, other fraud prosecutions

As the second year of PPP loans winds down, expect a surge in allegations by employees who feel declining allegiance to their employers, attorneys say.

By Robert Freedman • Jan. 26, 2021 -

Companies denied PPP forgiveness can take tax credit, IRS says

A change Congress made in December allows the credit for some PPP loan recipients.

By Robert Freedman • Jan. 26, 2021 -

SEC. (2019). "Allison Herren Lee" [Photo]. Retrieved from SEC.

SEC. (2019). "Allison Herren Lee" [Photo]. Retrieved from SEC.

Deregulation critic Allison Herren Lee named acting SEC chair

The financial regulation specialist has been a voice against weakening the oversight structure protecting investors.

By Robert Freedman • Jan. 23, 2021 -

Deep Dive

SEC to take harder line on financial reporting, attorneys say

COVID-19 and ESG disclosures, information controls and SPACs could receive increased scrutiny, along with accuracy of filings as part of Biden’s SEC approach.

By Robert Freedman • Jan. 21, 2021 -

IRS postpones date for companies to repay deferred payroll taxes

Companies now must repay 2020 taxes delayed as part of pandemic-related relief by Dec. 31, rather than April 30.

By Jim Tyson • Jan. 21, 2021 -

What can go wrong with a SPAC? More than you can imagine, says CFO

In the rush to get a deal done, choose the right merger partner and watch costs, says 180 Life Sciences finance chief Ozan Pamir.

By Ted Knutson • Jan. 20, 2021 -

Deep Dive

Biden tax, oversight plans could add to M&A costs

Sellers can be expected to seek higher valuations to offset higher corporate tax rate and capital gains changes, deal specialists say. And some deals could get more regulatory scrutiny.

By Robert Freedman • Jan. 19, 2021 -

Biden expected to raise corporate tax rate, add tax on book income

Some $3 trillion in potential new tax income could go to infrastructure, alternative energy, and manufacturing as well as provide tax relief to middle- and lower-income households.

By Robert Freedman • Jan. 18, 2021 -

Former Clinton CFO, CFTC head Gary Gensler expected to be named SEC chief

Should the Senate confirm the long-time Washington policymaker, he will likely prioritize ESG reporting and tighter regulatory safeguards.

By Robert Freedman • Jan. 14, 2021 -

Deep Dive

2021 Outlook: Why, and how, the CFO should lead ESG efforts

This year, CFOs should prepare their companies for increased scrutiny on environmental, social and governance performance, if they haven't already.

By Jane Thier • Jan. 12, 2021 -

As fraud rises, CFOs must approach numbers skeptically, report finds

Executives might be committed to accuracy, but middle managers and others throughout the organization must be on board, too.

By Robert Freedman • Jan. 12, 2021