Treasury: Page 2

-

Businesses get more predictable tax runway: EY

Many companies are still “running the numbers” to determine how Trump’s budget will effect their bottom line, but it ushers in a period of “relative tax certainty,” EY’s Adam Francis says.

By Maura Webber Sadovi • July 25, 2025 -

What to know about the $7.25 minimum wage

This week marks the 16th anniversary of the federal minimum wage’s last increase.

By Ginger Christ • July 24, 2025 -

IPOs surge 35% in H1 despite policy shifts, market volatility: EY

Global capital markets this year are apparently adapting to political and geopolitical shocks, improving the outlook for IPOs, EY said.

By Jim Tyson • July 22, 2025 -

Tariffs to slow spending, economic growth during H2: Conference Board

Consumers face an average effective tariff rate of 20.6% and a 2.1% short-run increase in prices, the Yale Budget Lab said.

By Jim Tyson • July 21, 2025 -

Consumer sentiment edges up on expectations inflation will cool

Recent stability in consumer sentiment coincides with mixed signals on employment and retail sales.

By Jim Tyson • July 18, 2025 -

Instant paychecks pose moral dilemma for Yooz CFO

The accounts payable software company may offer earned wage access benefits to employees. Yooz CFO John Gronen has reservations.

By Maura Webber Sadovi • July 18, 2025 -

Retail sales jump despite consumer worries about tariffs, jobs, economy

The report of robust spending coincides with warnings by several Federal Reserve officials that import duties in coming months will push up prices.

By Jim Tyson • July 17, 2025 -

Inflation rises to 2.7% as companies shift tariff costs to consumers

Persistent inflation prompted traders in interest rate futures to all but rule out a reduction in borrowing costs during a Federal Reserve policy meeting on July 29-30.

By Jim Tyson • July 15, 2025 -

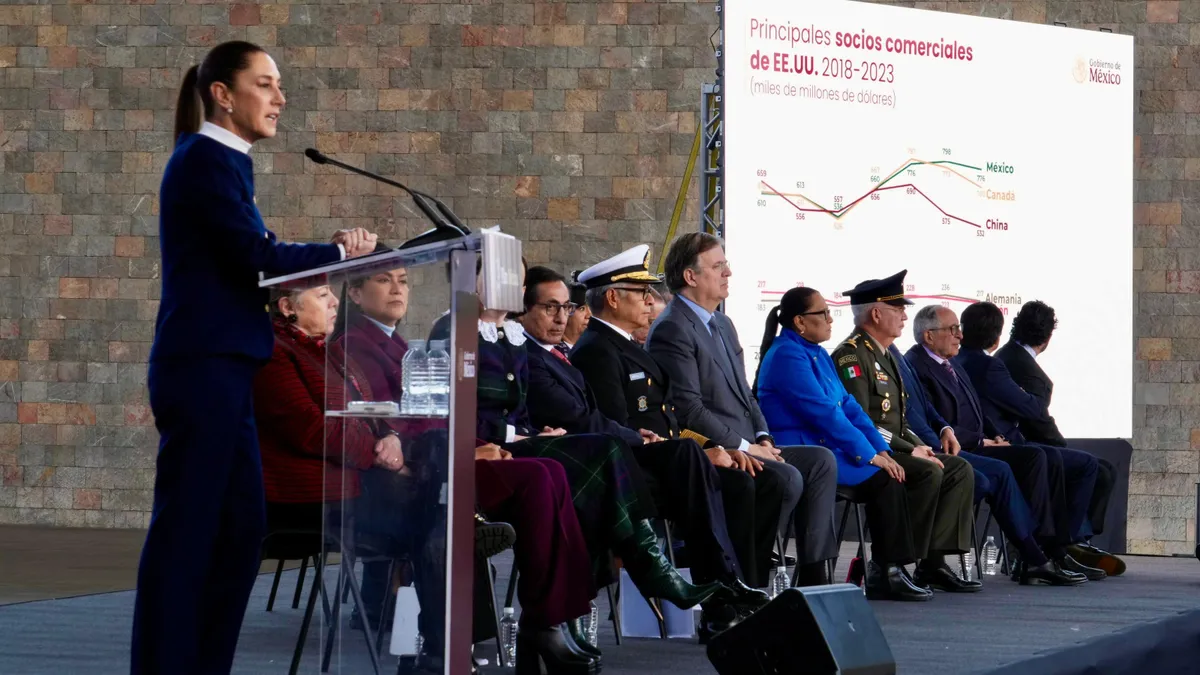

(2025). Retrieved from Presidencia de la República.

(2025). Retrieved from Presidencia de la República.

CFOs already feel tariffs biting into margins, sales: KPMG

It’s unclear how long companies can continue delaying investments as they await tariff certainty without hurting their businesses, KPMG’s Joe Lackner said.

By Maura Webber Sadovi • July 14, 2025 -

US corporate bankruptcies hit 15-year H1 high: S&P

The petition volume this year through June is on pace to make 2025 one of the busiest years for bankruptcy filings in over a decade, according to an S&P Global report.

By Maura Webber Sadovi • July 11, 2025 -

Trump rolls out reciprocal tariffs for Japan, South Korea, others

The U.S. detailed the rates it will impose on imports from certain countries starting Aug. 1 in identical letters shared by the president Monday.

By Philip Neuffer • Updated July 8, 2025 -

Retrieved from White House.

Retrieved from White House.

Trump’s megabill: Quick CFO takeaways

No matter where finance leaders stand on the political spectrum, President Trump’s reconciliation bill warrants attention as it is poised to touch bottom lines for many years to come.

By Maura Webber Sadovi • July 7, 2025 -

Labor market slows as jobless claims rise to highest level since 2021

The job market is “progressing solidly, although more slowly than before,” Mary Daly, president of the Federal Reserve Bank of San Francisco, said.

By Jim Tyson • June 26, 2025 -

Stablecoins could bridge legacy finance-crypto gap, Bastion exec says

Ripple alum Vince Tejada sees “an explosion of adoption” for stablecoins — once the ongoing regulatory evolution settles into clear guidance.

By Grace Noto • June 26, 2025 -

Fed on hold to see if tariff-induced inflation persists, Powell says

“A majority of my committee has said that they do expect to cut rates between now and the end of the year,” Federal Reserve Chair Jerome Powell said.

By Jim Tyson • June 25, 2025 -

Powell affirms ‘wait-and-see’ rate policy, bucking Trump’s call for cuts

Since the Federal Reserve met last week, two policymakers have said they may favor a quarter-point reduction in the main interest rate at a July 29-30 meeting.

By Jim Tyson • June 24, 2025 -

White House redoubles pressure on Powell to cut Fed’s main interest rate

Republican lawmakers on Tuesday may chime in with criticism if Fed Chair Jerome Powell affirms a “wait-and-see” monetary policy approach in testimony to a House committee.

By Jim Tyson • June 23, 2025 -

Economy heading toward ‘significant slowdown,’ Conference Board says

“Maybe we should start thinking about cutting the policy rate at the next meeting, because we don’t want to wait until the job market tanks,” a Federal Reserve official said.

By Jim Tyson • June 20, 2025 -

Senate pitches permanent TCJA tax breaks

The Senate proposal would make the trio of tax-relief provisions from the 2017 Tax Cut and Jobs Act permanent. In contrast, the House bill would only extend them through 2029.

By Maura Webber Sadovi • June 20, 2025 -

Fed holds main interest rate steady, expects two cuts later in 2025

Policymakers have left borrowing costs unchanged this year while balancing signs of a softening labor market against concerns that U.S. tariffs will stoke inflation.

By Jim Tyson • Updated June 18, 2025 -

Deep Dive

7 CFO tips for thriving despite ‘perma-crisis’ turmoil

“Foundational rules for risk management have been fundamentally altered forever,” the former CEO of the Institute of Internal Auditors said.

By Jim Tyson • June 17, 2025 -

Economy to slow, inflation to persist above Fed 2% goal: NABE survey

A rise in oil prices from war between Iran and Israel threatens to weaken economic growth and increase price pressures.

By Jim Tyson • June 16, 2025 -

Consumer sentiment rises in June, buoyed by lull in tariff war

Still, survey results show “consumers remain guarded and concerned about the trajectory of the economy,” a University of Michigan economist said.

By Jim Tyson • June 13, 2025 -

Costco controller passes the torch after near-decade tenure

The decision to pick its new controller from its ranks aligns with the warehouse club retailer’s history of developing and keeping its financial bench talent.

By Maura Webber Sadovi • June 12, 2025 -

Inflation cools more than predicted as companies draw down inventories

Falling price pressures and signs of labor market stability reinforce the wait-and-see policy stance of the Federal Reserve, economists said.

By Jim Tyson • June 11, 2025