Strategy & Operations: Page 66

-

Nearly 40% of large companies pose biodiversity threat: Moody's ESG study

A Moody’s study aimed at measuring “biodiversity risks” in investment and lending portfolios found that 38% of 5,300 global companies operate at least one facility causing loss of habitat.

By Jim Tyson • May 28, 2021 -

Asia recession taught Levi Strauss CFO about in-house strength

The experience of others in an organization can be a finance leader’s best resource in times of need, Harmit Singh says.

By Robert Freedman • May 28, 2021 -

Explore the Trendline➔

Explore the Trendline➔

lorozco3D via Getty Images

lorozco3D via Getty Images Trendline

TrendlineCompensation: solving the cost-talent puzzle

In today’s strong labor market, CFOs leery of raising wages find creative ways to find and retain key employees.

By CFO Dive staff -

Gensler pledges tough SEC scrutiny of SPACs, warning of fraud risk

The SEC will “closely look” at each stage of SPAC financing to ensure adequate investor safeguards, Chair Gary Gensler said in congressional testimony.

By Jim Tyson • May 27, 2021 -

Getting your working capital ratio right

Whether your ratio should be closer to 1.2 or 1.8 is less important than what your cash conversion cycle is telling you, cash management specialists say.

By Ted Knutson • May 27, 2021 -

CFO taps global cultural capital to advance priorities

Scoular finance chief Andrew Kenny credits interaction with global colleagues with giving him cross-cultural insight that can be leveraged to advance his organization's priorities.

By Robert Freedman • May 26, 2021 -

AI will yield biggest return in CFO spending during coming decade: Gartner

Spending on artificial intelligence will help CFOs achieve outperformance more than any other investment, Gartner predicts.

By Jim Tyson • May 26, 2021 -

How CFOs' digital conservatism hinders progress

When it comes to implementing digital technology, nearly three quarters of CFO respondents said their teams are too cautious, which can dramatically slow growth, Gartner research found.

By Jane Thier • May 26, 2021 -

Retrieved from Twitter on April 22, 2021

Retrieved from Twitter on April 22, 2021

Twitter looks to add e-commerce features, CFO says

"You should be able to click and buy something on Twitter," Ned Segal said at the J.P. Morgan Global Technology, Media and Communications Virtual Conference Tuesday. "We’ve come to appreciate that people do a lot of research on Twitter before they buy something."

By Jane Thier • May 26, 2021 -

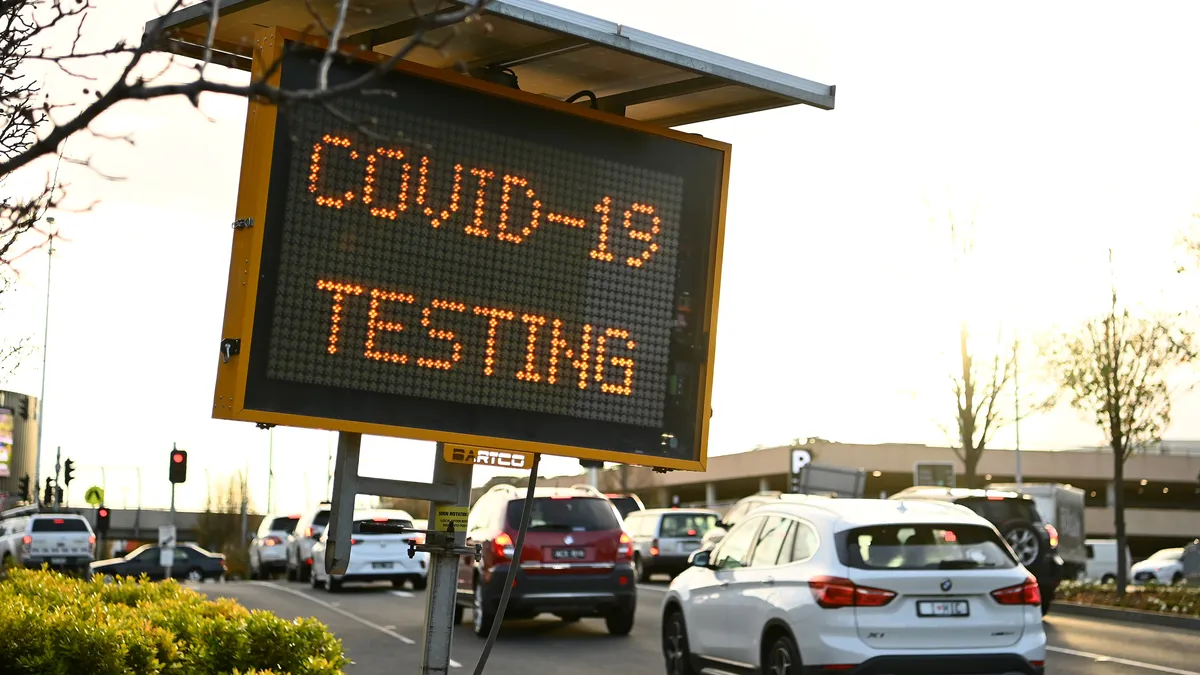

New data analysis may help predict pandemic recovery: AstraZeneca FP&A head

The coronavirus sped up adoption of automation at AstraZeneca and generated datasets that may help forecast recovery, according to the company's FP&A director.

By Jim Tyson • May 25, 2021 -

Working part-time can open new doors for CFOs

In addition to enabling a CFO to keep a hand in the profession after retirement, it can help fill several gaps that many professionals experience.

By Ted Knutson • May 22, 2021 -

Accounting, finance grads face different road to fill CFO shoes

New entrants to the business world are expected to bring data analytics, risk management, cybersecurity and business modeling to the table, say academic specialists.

By Ted Knutson • May 22, 2021 -

Biden aims to raise $700B over 10 years with tougher tax enforcement

The Biden administration during the next decade seeks to close the "tax gap" by 10% through more effective IRS pursuit of corporate and individual tax cheats.

By Jim Tyson • May 21, 2021 -

Legislation needed to smooth transition from LIBOR: Fed official

The Federal Reserve will bar the use of LIBOR in contracts after December 31, Vice Chair Randal Quarles said, underscoring the need for legislation to smooth the switch to a new reference rate.

By Jim Tyson • May 20, 2021 -

Labor shortages, rising wages intensify inflation threat: Summers

Despite rising wages, many companies are short on workers, signaling a growing threat of inflation, former Treasury Secretary Lawrence Summers said.

By Jim Tyson • May 19, 2021 -

Preparing for the CFO seat, with mentorship built in

The executive team at Herbalife Nutrition helped pave the way for Alex Amezquita’s finance leadership rise by giving him time to learn the ropes.

By Robert Freedman • May 19, 2021 -

Deep Dive

Up from the ashes: retailing CFOs get ready for a consumer rush

Retailing CFOs preparing for a "spring-loaded" consumer splurge provide insights for financial executives in industries less challenged by the coronavirus.

By Jim Tyson • May 18, 2021 -

A meeting of the minds: The evolving CMO-CFO relationship

Thanks to changes in technology, chief marketing officers are getting better at understanding the metrics behind their strategies and CFOs are using marketing analytics to deepen their business insights.

By Ramona Dzinkowski • May 18, 2021 -

Colonial hack a wake-up call to CFOs with legacy systems

Older systems leave finance and accounting operational data at risk of breach, security specialists say.

By Ted Knutson • May 14, 2021 -

Most companies increase spending on diversity training: survey

Roughly four in five companies are increasing their budgets for diversity training and for managing their performance in sustainable business practices, a OneStream Software survey found.

By Jim Tyson • May 13, 2021 -

Bankers' main CFO gripe: lack of transparency

CFOs and their treasurers can get more from their banking relationships if they treat them more as partnerships than customer-seller transactions, banking specialists say.

By Ted Knutson • May 13, 2021 -

Only 20% of CFOs can forecast revenue, earnings beyond a year: survey

Even after the pandemic shock, most CFOs forgo effective scenario planning and more than half lack the ability to forecast revenue and earnings beyond six months, according to a Prophix Software survey.

By Jim Tyson • May 11, 2021 -

Lack of automation preventing efficient financial close: CFO survey

Due to ineffective processes and technology, 51% of CFO respondents to Trintech's Global Financial Close Benchmark Report cited meeting deadlines and time pressures as their biggest challenges this year.

By Jane Thier • May 11, 2021 -

Companies losing out as insurers skirt rebates

Health carriers are said to be strategically overestimating how much they use premiums to pay claims to avoid returning money to policyholders.

By Robert Freedman • May 11, 2021 -

Half of companies lack LIBOR phase-out plan: Duff & Phelps

Despite regulatory pressure, more than half of financial services firms have not determined when they will stop using LIBOR in new contracts, according to a Duff & Phelps survey.

By Jim Tyson • May 10, 2021 -

Sponsored by EY

Enhancing funding plans when there are a variety of options

CFOs are busy navigating a (surprisingly) expansive menu of capital raising alternatives, weighing the pros and cons of disparate markets.

By David Brown, Head of US Equity Capital Markets, Ernst & Young Capital Advisors, LLC • May 10, 2021