Strategy & Operations: Page 67

-

Sponsored by BlackLine

AR intelligence: Providing new answers to old questions

BlackLine AR Intelligence optimizes working capital by boosting payment predictability and improving collections forecasting.

May 10, 2021 -

ESG reporting

Companies ignoring ESG may become 'uninvestable,' says investment bank chief

Interest in sustainability goals is growing "enormously" and companies that ignore the trend risk rejection by investors, according to Larry Wieseneck, co-president of investment bank Cowen.

By Jim Tyson • May 7, 2021 -

Explore the Trendline➔

Explore the Trendline➔

lorozco3D via Getty Images

lorozco3D via Getty Images Trendline

TrendlineCompensation: solving the cost-talent puzzle

In today’s strong labor market, CFOs leery of raising wages find creative ways to find and retain key employees.

By CFO Dive staff -

Deep Dive

Up from the ashes: Restaurant CFOs prepare for boom

Profit-hungry restaurant CFOs blindsided by the pandemic get ready for robust economic growth, offering lessons for leaders in less-stressed industries.

By Jim Tyson • May 6, 2021 -

Rising inflation, higher taxes pose 'headwinds' to growth, Schenker says

Look for 'eye-popping inflation numbers' and 'horse trading' on taxes as potential economic drags, economist Jason Schenker says.

By Jim Tyson • May 6, 2021 -

Zig Zag CFO ready to capitalize on cannabis

After weathering a tough period, Turning Point Brands has the resources to become a major presence as legalization expands across the country.

By Robert Freedman • May 5, 2021 -

'Gender bonds' empowering women likely to improve issuers' credit outlook: Moody's

Issuance of bonds tied to women’s economic empowerment will likely grow while boosting issuers’ credit standing, Moody’s said.

By Jim Tyson • May 5, 2021 -

Walmart gives suppliers option for early payment to help increase access to capital

The retailer is expanding its early payments program through a partnership with the financial technology company C2FO.

By A.B. Brown • May 5, 2021 -

PPP runs out of funds for most lenders

About $8 billion remains available through MDIs and CDFIs, the Small Business Administration told banking trade groups Tuesday. But the portal has largely stopped accepting applications, the American Bankers Association said.

By Dan Ennis • May 5, 2021 -

How CFOs and CEOs collaborate best

Both executives want strong performance, but the CEO often focuses on opportunities and potential, while the CFO emphasizes realism and honest risk assessment. How should they strike a balance?

By Jane Thier • May 4, 2021 -

ESG investing fails to outperform: study

ESG investing offers neither superior returns nor risk protection, and investors seeking outperformance are looking “in the wrong place,” a Scientific Beta study finds.

By Jim Tyson • May 4, 2021 -

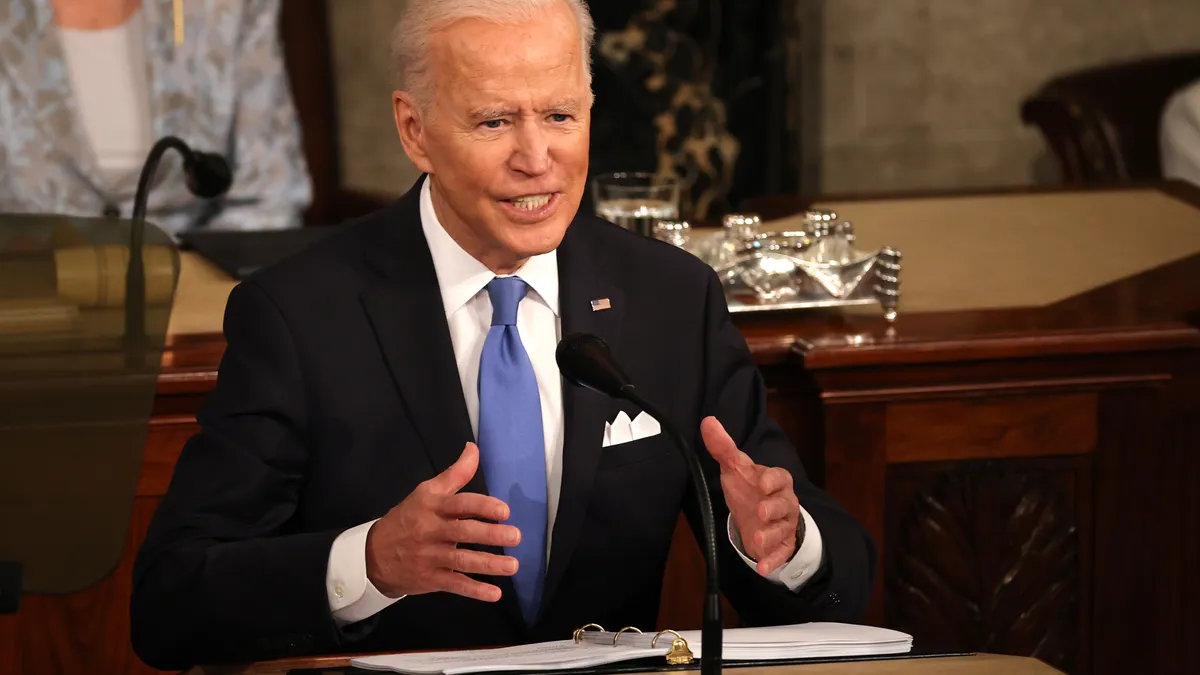

Retrieved from The White House.

Retrieved from The White House.

Corporate inversions could return under Biden tax plan

Despite hurdles, companies could merge with a smaller foreign company and relocate outside the U.S. to avoid a big tax bite.

By Robert Freedman • May 4, 2021 -

Leveraging cash flow's multiplier effect on valuation

Most finance tools are optimized for GAAP but they can be made more effective for increasing company value by enabling better cash management, finance leaders say.

By Robert Freedman • May 3, 2021 -

Biden climate policy poses credit risks for 'carbon-intensive' companies: Moody's

Biden administration plans for curbing climate change will increase credit risks for companies in carbon-intensive industries while creating business opportunities, Moody’s said.

By Jim Tyson • April 30, 2021 -

Can't get funding? It's likely not for the reason you're told

Don’t expect investment firms to be upfront about why they turn down your company, SafeGraph CEO Auren Hoffman says.

By Robert Freedman • April 30, 2021 -

Deutsche Bank posts strong quarter, OKs 3-day remote work: CFO

James von Moltke said the bank, going forward, intends to let employees work from home 40-60% of the time.

By Jane Thier • April 29, 2021 -

Multinationals reported $6.16B in negative forex exposure for Q4: study

A decline in negative foreign exchange impact during the fourth quarter was probably "the calm before the storm" that likely occurred during the first quarter of 2021, according to Kyriba.

By Jim Tyson • April 29, 2021 -

Retrieved from The White House.

Retrieved from The White House.

Biden plan would increase taxes on multinationals by $1.2 trillion over 10 years: study

Biden’s proposal to raise corporate taxes to fund $2 trillion in infrastructure spending would harm U.S. competitiveness, the Tax Foundation says.

By Jim Tyson • April 28, 2021 -

CFO role has grown during pandemic: Accenture

CFOs have taken on greater responsibilities since the onset of COVID-19, especially those at government agencies handling record pandemic aid, Accenture said.

By Jim Tyson • April 27, 2021 -

DoorDash juggling fees, commissions to retain restaurants

The delivery app's new pricing structure uses higher consumer fees to help offset reduced revenue from lower commissions.

By Robert Freedman • April 27, 2021 -

HSBC CFO: Bank 'very much' wants to shift to hybrid working model

"We've basically baked in about half of the cost of travel going forward," finance chief Ewen Stevenson says.

By Jane Thier • April 27, 2021 -

Industry Dive/CFO Dive, data from Industry Dive

Industry Dive/CFO Dive, data from Industry Dive

Financial crisis tested CFO's management lessons

The mortgage meltdown was trial by fire for a finance leader whose only experience to that point was public auditing.

By Robert Freedman • April 26, 2021 -

Deep Dive

Up from the ashes: How airline CFOs are preparing for the post-pandemic rebound

CFOs of airlines challenged by the pandemic are preparing for a rebound in demand, offering lessons for financial executives in less-stressed industries.

By Jim Tyson • April 26, 2021 -

Capital raises, along with expectations, getting bigger, VC funder says

For hot companies in hot markets, the amounts are exceptional, Christoph Janz of Point 9 Capital says.

By Robert Freedman • April 23, 2021 -

After bombshell quarter, Chipotle's CFO focuses on sustainability

Amid discussions of carbon neutrality, a $15 federal minimum wage and a quickly evolving fast casual landscape, Jack Hartung says the chain remains committed to its employees and agricultural partners.

By Jane Thier • April 23, 2021 -

SPAC market during Q1 showed 'explosive growth': Duff & Phelps

The SPAC market boomed during the first quarter of 2021, Duff & Phelps said, noting that SPAC warrants this month have come under regulatory scrutiny.

By Jim Tyson • April 23, 2021